Bitcoin is trending decrease when writing, cooling off after the encouraging leg up on August 23. Though the uptrend stays, and the coin is just not distant from $63,000, there isn’t a discounting the potential of sellers urgent on. The alignment with the dip of early August might set off one other wave of liquidation, inflicting panic.

Bitcoin Shaky, The First Two Ranges To Watch

Technically, Bitcoin is inside a bullish breakout formation from the bull flag established after the growth on August 8.

Moreover, from a quantity evaluation perspective, bulls stand an opportunity since costs are nonetheless contained in the bull bar of August 23. So long as buying and selling quantity stays mild as costs trickle decrease, consumers could soar again and drive costs larger above $66,000.

Associated Studying

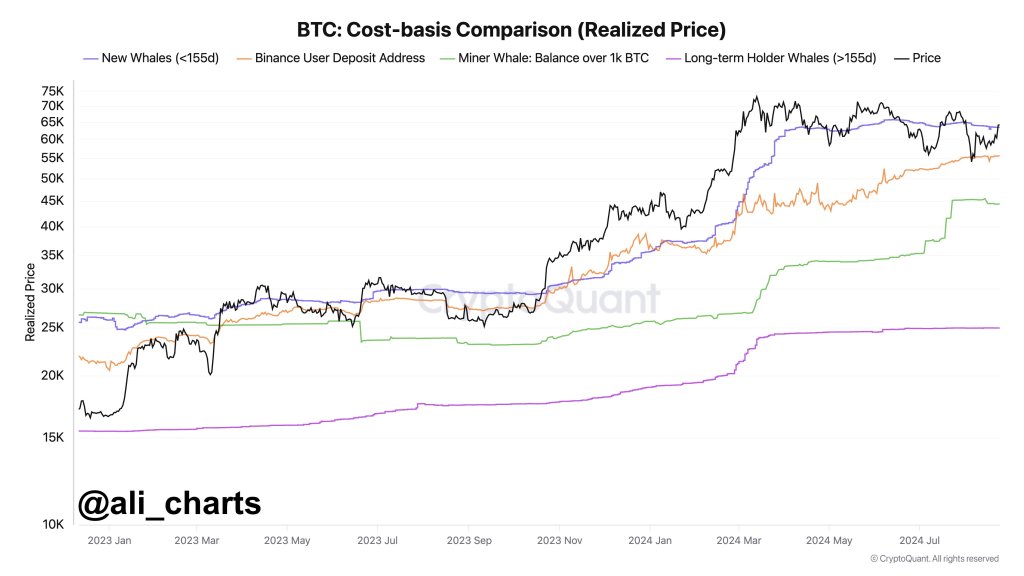

Even so, assuming Bitcoin bears have the higher hand, one analyst on X thinks it is going to be necessary for merchants to intently monitor how costs will react on the following 4 response traces. From the Bitcoin cost-basis comparability through CryptoQuant, the primary assist stage, now resistance following the continuing dump, is $63,450.

At this worth level, the analyst mentioned that is the typical worth at which new whales purchase BTC. It stays to be seen whether or not costs will get well and print above $64,000 within the coming days.

Nonetheless, the truth that whales are within the image is a internet optimistic. Usually, whales, in contrast to retailers, are usually HODLers and gained’t be shaken off at any time when costs fluctuate.

If bears are unyielding and costs break beneath $60,000, the analyst continued merchants ought to watch how costs react at $55,540. From the dealer’s evaluation, Binance customers have positioned their assist at $55,540. Subsequently, costs dropping beneath this stage might simply set off panic promoting as merchants on this alternate dump scramble for security.

Miners And Lengthy-Time period Holders: The Final Partitions

A stage deeper, a key assist stage might be $44,400. This zone is the place most miners are deemed worthwhile. So long as costs commerce above this line, most miners, most of whom are whales, can HODL, anticipating worth positive factors. In early August, Bitcoin fell onerous however didn’t breach this zone, highlighting its significance relating to BTC worth motion.

Associated Studying

Under this, $25,000 is one other accumulation stage that merchants will be careful for if there’s a common collapse. The $25,000 is the typical worth at which long-term holders (LTHs) purchased. LTHs are those that purchased BTC over 155 days in the past.

This cohort principally contains whales and community believers. Technically, a break beneath $50,000 and August 2024 lows is perhaps the premise for an additional leg all the way down to $40,000 and worse.

Whereas bears may take over, there are additionally supportive elements that proceed to spur bulls on. One of many world’s largest asset managers, BlackRock, lately added BTC to its Strategic International Bond Fund as a hedge towards conventional belongings. Its spot Bitcoin ETF, IBIT, already holds billions of BTC on behalf of its institutional purchasers.

Characteristic picture from DALLE, chart from TradingView