RUNE, the native token of the cross-chain decentralized alternate, THORChain, is beneath stress. From the every day chart, the token is down practically 60% from Could highs and stays flat even because the broader crypto market recovers.

Whilst RUNE flatlines, there may be confidence that costs might rally within the coming days primarily due to basic components and efforts made by the event group.

THORChain Income Rising After Swap Charge Increment

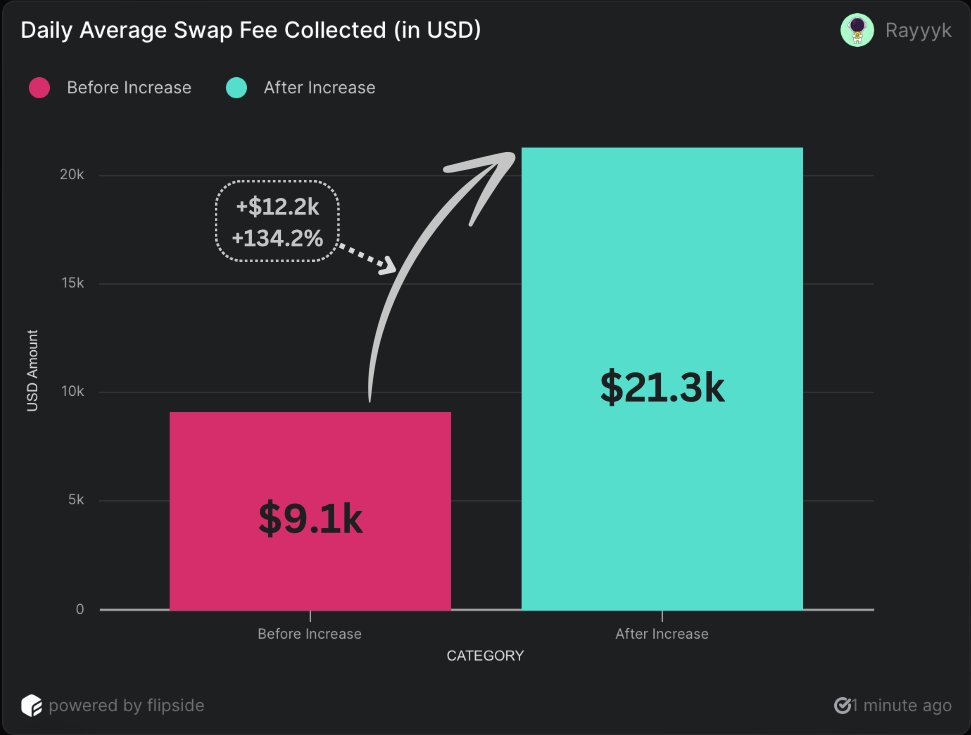

In a submit on X, one analyst famous that THORChain has practically doubled its income up to now two days following the group’s determination to extend the minimal swap charge on the DEX.

Just lately, THORChain node operators permitted and carried out a proposal to extend the swap charge for layer-1 native exchanges to 0.05%. The seemingly minor change, the analyst notes, has profoundly impacted THORChain’s protocol, growing every day income by practically 100%.

Curiously, the analyst famous that whereas charge increments in protocol are likely to affect consumer expertise negatively, it had the alternative impact on THORChain. Whereas the swap charge rose, customers weren’t deterred. As an alternative, swap quantity steadied whereas the common charge from each transaction surged.

As transaction charges rise, weekly liquidity charges on THORChain now exceed block reward, a serious milestone for the DEX. Notably, the numerous shift in income era would additional drive the RUNE burning price as soon as ADR 17, a group proposal, is carried out within the coming days.

The extra RUNE is taken out of circulation, the scarcer the token turns into, lifting costs larger. As soon as ADR 17 is carried out, the protocol will purchase and burn $1 price of RUNE for each $10,000 income generated. Because of this, rising income as a result of swap charge improve means extra RUNE shall be torched.

Influence Of RUNEPool On Liquidity: Will RUNE Break $5?

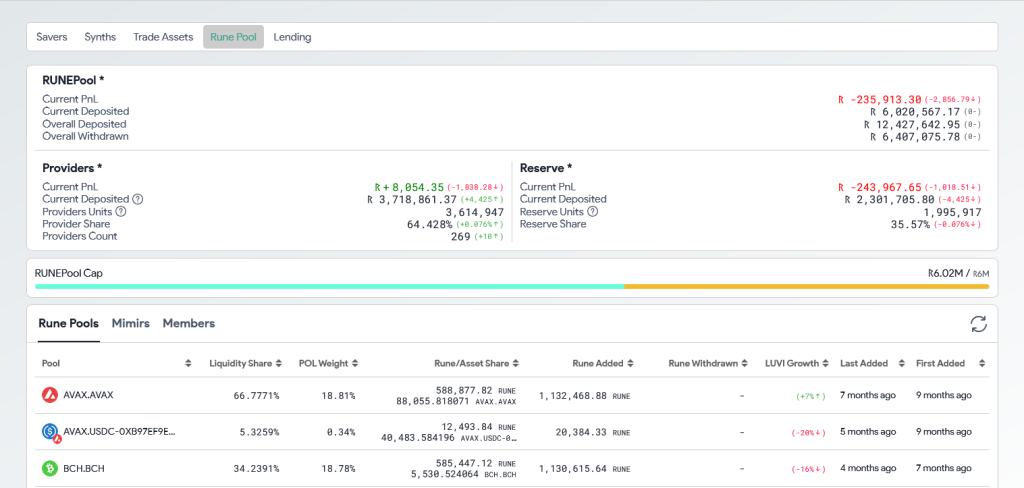

In late July, THORChain additionally launched RUNEPool to assist additional incentivize liquidity provision. Customers can freely deposit their RUNE through THORSwap and THORWallet interfaces right into a pool of diversified tokens by this characteristic.

On this manner, they assist cut back the dangers of impermanent loss whereas growing liquidity. As of August 9, over 3.7 million RUNE have been deposited by 265 liquidity suppliers into the RUNEPool.

Regardless of these adjustments, RUNE stays beneath immense promoting stress, though it’s regular at press time. Following the bear breakout in early August, pushing costs beneath July lows, the token has struggled. Nonetheless, if there’s a restoration from spot charges to above July highs of round $5, the coin may surge to over $7.5.