For the crypto and broader monetary market, FOMC day is upon us as soon as once more at present. And analysts agree that at present’s assembly can be one of the vital vital in recent times. Kurt S. Altrichter, a monetary advisor and founding father of Ivory Hill, even describes at present’s FOMC assembly because the “most vital of your life.” In a brand new put up on X, Altrichter explains why.

FOMC Preview

Central to at present’s FOMC assembly is the Federal Reserve’s potential indication of a September fee reduce. In response to Altrichter, the monetary markets are virtually unanimously anticipating this transfer, with Fed fund futures indicating a near-certain chance of such an final result. “Market expectation is a robust sign for a September fee reduce,” Altrichter factors out, marking at present’s replace as a pivotal second for monetary markets.

The important thing query for at present is: “How strongly does the Fed sign a September fee reduce?” the skilled explains. Traders are directed to pay shut consideration to the FOMC’s assertion at 2:00 pm ET, particularly the third paragraph, which might subtly sign the Fed’s confidence in reaching its inflation targets.

Associated Studying

Altrichter advises, “Take a look at the third paragraph for this key sentence: The Committee doesn’t count on it will likely be acceptable to cut back the goal vary till it has gained higher confidence that inflation is shifting sustainably towards 2 %.” Any modification on this wording could be a transparent sign that the Fed is nearing its inflation management targets, doubtlessly paving the best way for fee changes.

Altrichter outlines a number of potential outcomes from the assembly, every related to particular market reactions. In a dovish situation, the Fed indicators a fee reduce for September. Then, Altrichter expects a broad market rally, particularly in sectors much less delicate to rates of interest. “Yields and the greenback ought to fall modestly with a modest rally in commodities,” Altrichter predicts, suggesting vital actions in normal and sector-specific indexes.

In a hawkish situation, there can be no change within the ahead steerage by the US central financial institution. If the Fed maintains its present stance with out hinting at future cuts, the markets may expertise a downturn. “Look out under and count on a pointy decline. SPX ought to fall by 1-2%,” he warns, noting that tech and progress sectors may comparatively outperform on account of their attraction throughout greater yield intervals.

How Will Bitcoin And Crypto React?

The potential changes in US financial coverage bear direct penalties for the Bitcoin and crypto markets. Crypto, typically seen as different investments, reacts sensitively to shifts in financial coverage, notably concerning rates of interest.

Associated Studying

If the dovish situation materializes, this might make Bitcoin and cryptocurrencies extra interesting. A sign of decrease future charges might drive elevated funding into the crypto market, doubtlessly main to cost will increase as traders search greater returns in different property.

Conversely, ought to the Fed sign reluctance to reduce charges, indicating a stronger financial outlook or considerations about inflation, this might strengthen the US greenback and improve yields on conventional monetary devices. Such an setting may result in a pullback within the crypto markets, because the comparative benefit of Bitcoin and cryptocurrencies diminishes in opposition to strengthening conventional yields.

Max Schwartzman, CEO of As a result of Bitcoin Inc, commented by way of X: “FOMC is [today] & its extremely vital as we get into the tip of this fed cycle… Right here is how the final 11 conferences have gone for Bitcoin…”

Thus, at present’s FOMC assembly is a watershed second for monetary markets globally, with vital implications for each conventional and crypto markets. As Altrichter succinctly places it, “A Sept Fed fee reduce has pushed the 2024 bull market. Tomorrow’s assembly will both reinforce that tailwind or refute it. If the Fed indicators a reduce, the rally continues. No sign: markets might get ugly.”

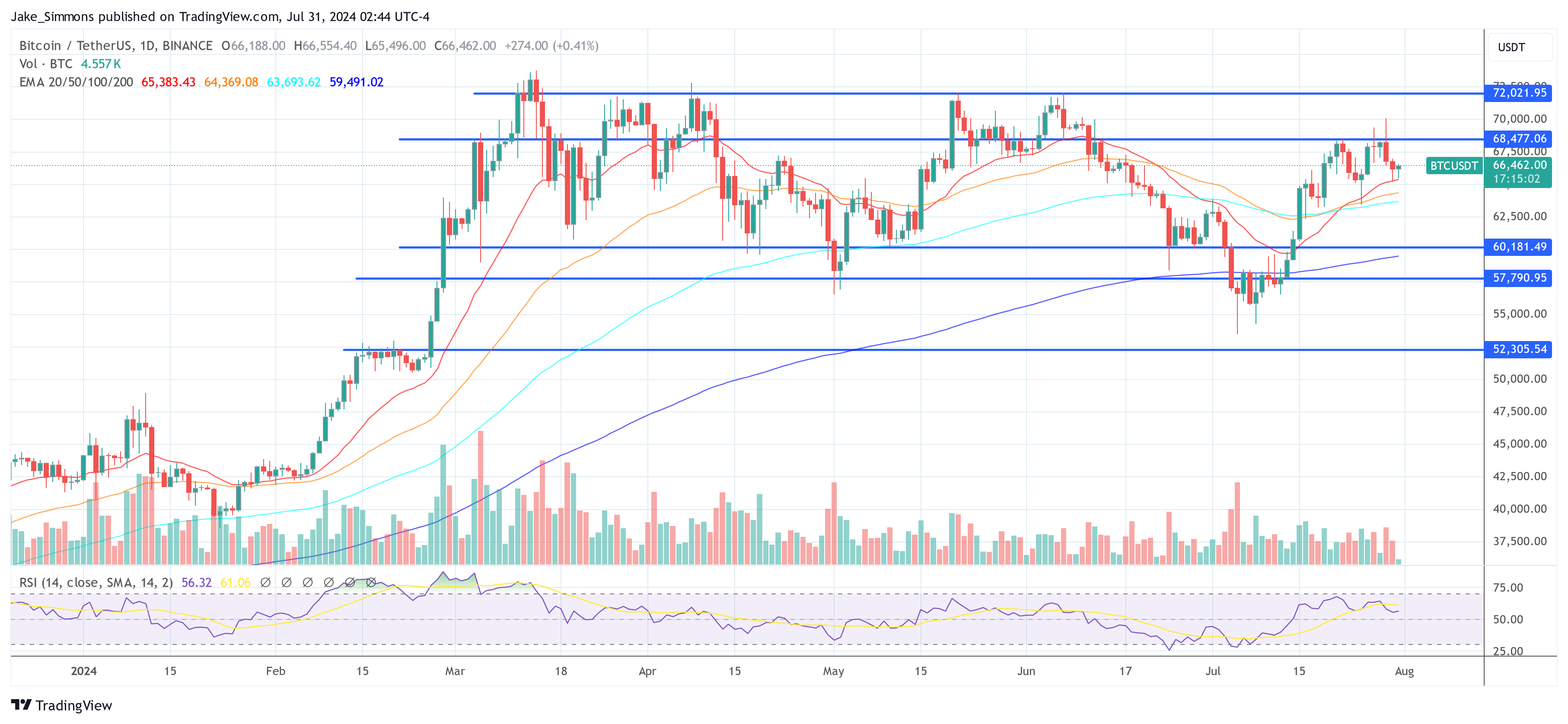

At press time, BTC traded at $66,462.

Featured picture from Shutterstock, chart from TradingView.com