With an enormous sell-off of Bitcoin, the Germany has basically modified the bitcoin scene. Germany has lately offloaded an astounding 49,850 BTC inside a couple of weeks. Executed throughout many exchanges together with Coinbase, Kraken, and Bitstamp, the transactions helped to scale back doable worth loss.

Associated Studying

Apparently, the German authorities began these gross sales due to worries a couple of notable drop within the worth of Bitcoin. With the common worth for a Bitcoin about $57,000, the full earnings got here to somewhat over $2.8 billion.

Fascinatingly, Germany misplaced out on an additional $400 million in doable beneficial properties whereas Bitcoin is presently valued at $66,425. Germany now solely holds lower than one BTC.

Strategic Bitcoin Strikes By The US Authorities?

The US authorities has been making information with its personal sensible BTC strikes because the mud settles following Germany’s big Bitcoin sell-off.

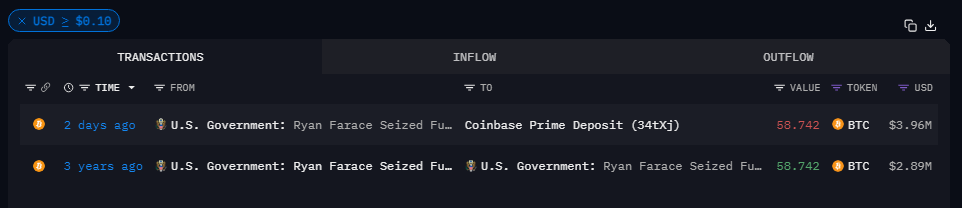

Blockchain intelligence platform Arkham Intelligence discovered on July 22, 2024 a noteworthy transaction involving the motion of 58.742 BTC from a authorities pockets to Coinbase Prime Deposit. Valued at about $4 million, this transfer has generated curiosity and worries among the many crypto neighborhood.

The US’ possession of round 213,200 BTC, with a valuation of roughly $14.4 billion, consists largely of property confiscated from legal entities. The seizure of 69,370 BTC from the infamous Silk Street case in August 2023 was probably the most publicized of those seizures.

Including to the intrigue is that this most up-to-date transfer, which comes after a earlier transaction that befell on June 26 and noticed the US authorities transferring 4,000 Bitcoin to the identical Coinbase pockets.

Some persons are involved that the USA might observe Germany’s instance and start a big sell-off because of these developments.

Germany & US Bitcoin Strikes: Market Results

Buyers and market consultants haven’t missed the numerous modifications governments have made on Bitcoin. Already, Germany’s sell-off illustrated the numerous affect such insurance policies might have on investor confidence and market stability. The fear of a comparable US authorities motion has added even one other stage of uncertainty to the market.

Associated Studying

Bitcoin’s worth has been going up and down rather a lot, so the market temper has been tight. Bitcoin is presently promoting at $66,420, which reveals how the market feels about these authorities actions. It has misplaced greater than 2% within the final 24 hours.

These modifications are inflicting reevaluation of investor techniques. Though some view the federal government sell-offs as an indication of warning, others view them as prospects for market corrections. The state of cryptocurrencies remains to be a lot formed by the conduct of huge BTC holders, particularly governments.

Featured picture from Pexels, chart from TradingView