HodlX Visitor Publish Submit Your Publish

What’s DePIN

There’s been numerous buzz recently about DePINs (decentralized bodily infrastructure networks).

This sector is attracting numerous consideration as a result of it has an enormous potential consumer base and a novel solution to develop infrastructure networks from the bottom up while not having a government.

As a report by Messari suggests, DePIN might add $10 trillion to the worldwide GDP (gross home product) within the subsequent decade and $100 trillion the last decade after.

DePINs are seen by some as a game-changer for a way we distribute sources world wide not simply bodily issues however digital ones too.

In addition they maintain promise as a model new solution to construct large-scale infrastructure initiatives.

Put merely, DePINs are the decentralized model of conventional infrastructure and providers we people use.

On the coronary heart of every of those initiatives, there may be an financial system that assure the liveliness of its choices.

This occurs by incentivizing community contributors i.e. suppliers to allocate their capital or unused sources like cupboard space.

We think about a venture within the DePIN sector if it’s a blockchain-based platform that incentivizes individuals to affix a community and preserve bodily {hardware} or software program providers.

Such providers span throughout an enormous panorama, together with however not restricted to IoT (web of issues) sensors, storage, climate stations, Wi-Fi, computational energy, vitality grids, mapping (navigation) and even meals supply.

The last word purpose right here is to create a distributed and clear system, boosting the scalability and effectivity of immediately’s infrastructures.

These infrastructures can be found in two main classes.

- {Hardware}-focused or PRNs (bodily useful resource networks) These sources are tied to a selected location. They supply providers in a specific space and sometimes can’t be simply moved elsewhere. Wi-fi, vitality, and sensors (e.g. climate, mapping, noise air pollution) networks all belong to this department.

- Software program-focused or DRNs (digital useful resource networks) like computing energy, storage, retrieval, information / AI (e.g., wholesale information) and providers marketplaces (e.g., skills, ride-sharing, meals supply, advert networks), which can be all location-independent and fungible.

How does DePIN profit us with actual world benefits

Traditionally talking, constructing a bodily infrastructure has at all times demanded an enormous quantity of capital and operational bills, making this trade dominated by large tech corporations like Amazon and Microsoft.

Now DePIN is right here to disturb the monopoly by leveraging blockchain know-how.

Decentralizing of bodily techniques has notable advantages over the centralized method, equivalent to the next.

- Increased degree of safety no single level of failure

- Transparency

- Value effectivity

- Scalability

- Monetary rewards for community contributors

How does a DePIN venture truly work

DePIN bridges between real-world infrastructure and the blockchain. Think about it like this there’s a bodily gear/useful resource owned by a supplier.

Then a particular software program acts as a intermediary, connecting this gear/useful resource to the blockchain. Lastly, a public ledger like an enormous logbook retains monitor of all the things.

Let’s dive deeper into the three elements talked about above.

Bodily gear / useful resource

DePINs depend on bodily infrastructure to be constructed and developed in the true world.

This infrastructure could be numerous issues, like sensors, automobiles, storage hardwares and even photo voltaic panels, sometimes managed by particular person / personal suppliers.

Middleware

This half acts like a translator between the blockchain and the bodily world. It makes use of a particular system, like an oracle, to usher in real-world information.

This information is then examined to determine how a lot customers are contributing and the precise want for the service.

Blockchain structure

DePINs make the most of blockchain know-how’s capabilities. Blockchains operate as tamper-proof registries and ledgers, making them superb for monitoring gadgets and in addition establishing token-based digital economies.

The blockchain performs three necessary roles in DePINs i.e., administration, funds and record-keeping that are mentioned beneath.

- Administration DePINs construct permissionless techniques based mostly on blockchain know-how, which means that anybody can change into a consumer or a supplier if they’ve important sources / gear.

- Funds Customers pay for providers via blockchain-based techniques, whereas suppliers get rewarded for his or her contributions.

- Report-keeping Each single exercise and transaction within the community is recorded on the blockchain, which is usually obtainable for public viewing.

Final however not least, DePIN networks have a magic wand that helps them overcome the difficulties with constructing a sustainable, practical and actually decentralized bodily infrastructure in the true world.

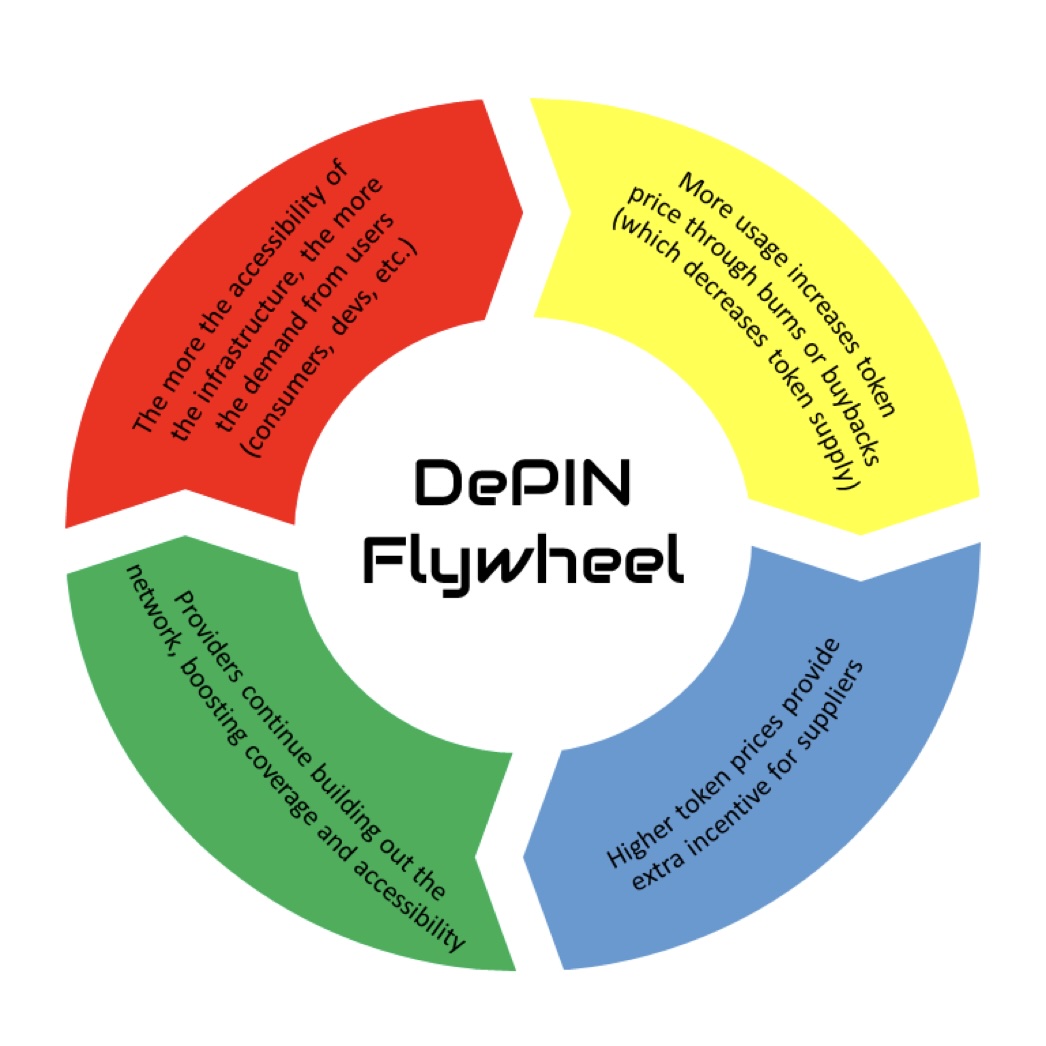

That secret superpower is named, ‘The DePIN Flywheel.’ The important thing to a profitable DePIN venture is a self-sustaining loop of progress.

Tokens act as rewards to draw individuals to affix the community at the start, fixing the problem of discovering preliminary contributors, often known as a ‘chilly begin’ problem.

As extra suppliers be a part of the community, customers who want to use its infrastructure are drawn in.

Since customers sometimes pay for providers with the venture’s native token, this rising demand drives up the worth of that token.

Increased token costs then entice much more individuals to contribute to the community, preserving the cycle going. This constructive loop can gasoline the venture’s long-term progress.

To raised assure the well being and performance of a decentralized infrastructure, there could also be additionally some penalty mechanisms utilized to the system.

Similar to some rental agreements require a safety deposit, DePIN suppliers typically must pledge collateral.

This acts as a form of insurance coverage to make sure they ship good service. If a supplier fails to fulfill expectations or tries to cheat the system, they face penalties.

This might imply dropping out on rewards they earned, having a portion of their deposit taken away, and even getting faraway from the community totally.

Challenges and dangers

DePINs sound like a game-changer with regards to constructing infrastructure, however there are some large hurdles to beat earlier than they hit the mainstream.

Regulatory roadblocks

DePINs have the potential to revolutionize industries like telecoms, however these sectors are identified for tight laws.

To learn on a regular basis customers, DePIN initiatives and these regulated industries must work collectively and discover widespread floor.

However at the least for now, DePINs are much less more likely to set off regulatory considerations in comparison with some monetary crypto initiatives, as in DeFi sector.

That is partly evident by the provision of DePIN initiatives on app shops and their partnerships with established corporations. This means DePINs could be a safer area of interest inside the crypto world.

The battle of conventional infrastructure versus DePIN

The massive query is how centralized opponents on this house will react to DePINs.

Will they attempt to shut them down, like by lobbying? Will they unfold FUD (worry, uncertainty and doubt) round them? Will they attempt to manipulate the token costs?

Value volatility

DePIN initiatives might need an amazing thought, however their success hinges on their token’s value. When the worth goes up, it attracts new customers who desire a piece of the rewards.

However when the market takes a downturn and the token value falls, suppliers would possibly abandon the venture particularly in instances that there’s a low market cap and buying and selling quantity.

This may snowball right into a loss of life state of affairs the place the worth retains dropping.

This value fluctuations may also have impacts on the opposite aspect i.e., the demand aspect. If the token value shoots up too quick, it would scare new customers away.

Discovering the precise stability just isn’t simple. DePIN initiatives want sensible designs for his or her tokenomics and value adjustment measures to handle value swings to maintain issues secure and dealing.

The intrinsic reliability of conventional infrastructure

One problem for DePINs is that they won’t be fairly as reliable as centralized infrastructure.

Conventional techniques are like machines with a single management heart. Everybody is aware of who’s liable for what, and if one thing breaks, they will repair it shortly.

DePINs, alternatively, distribute the accountability amongst quite a few contributors, which might make it trickier and slower to handle and clear up issues.

DePIN just isn’t on the radar of the general public

These initiatives disturb the monopoly and may provide safer, broader and even cheaper choices than conventional techniques however they’re flying beneath the radar for most individuals.

DePINs want to boost consciousness to succeed in a wider viewers and acquire traction.

The longer term’s outlook

The probabilities for DePINs are infinite. Think about utilizing them to enhance vitality grids, communication networks, transportation techniques and even meals supply.

DePINs might even make issues like healthcare and schooling extra accessible and cheaper. Over the subsequent a long time, we additionally count on DePINs to develop even greater, tackling extra essential infrastructure wants.

Suppose toll roads, parking garages, anti-pollution tech and provide chain administration.

Nonetheless, realizing this imaginative and prescient requires collaboration amongst stakeholders, regulatory help and technological growth to handle current challenges like regulatory considerations, aggressive benefits and value fluctuations.

That mentioned, ongoing innovation appears to be the important thing to unlock the complete potential of DePINs.

Mehran Tabrizi has been within the Internet 3.0 and crypto house for 3 years throughout which period he has acquired expert-level data in areas like predicting the traits, discovering initiatives that will have a brilliant future and analyzing completely different elements of a venture, equivalent to group, tokenomics, growth, know-how, market, on-chain information and extra.

Comply with Us on Twitter Fb Telegram

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in affiliate marketing online.