Over the previous few days, Bitcoin has seen fairly a notable rebound in its value, rising from as little as the $53,000 degree final week to buying and selling as excessive as above $66,000 within the early hours of Wednesday prior to now retracing to a present buying and selling value of $64,433.

This bullish value efficiency has been the downfall of roughly 50,436 merchants within the crypto market at present. Notably, in accordance with information from Coinglass, this variety of merchants has seen huge liquidations, bringing the present complete liquidations to $145.58 million.

Bitcoin merchants felt the brunt of this complete liquidation, seeing roughly $46.22 million shared evenly between brief and lengthy positions, indicating the asset’s blended trajectory previously day alone.

Associated Studying

Bitcoin: Greater Liquidations Incoming

Whereas latest buying and selling actions have triggered hundreds of thousands of {dollars} in liquidations, additional information exhibits that this situation may escalate dramatically, turning into billions if Bitcoin continues its ascent in the direction of document highs, breaching a notable mark.

Notably, as reported by MartyParty, a outstanding crypto fanatic in the neighborhood, ought to Bitcoin’s value hit $72,400, the market would really feel the impression, with practically $19 billion in Bitcoin brief positions poised for liquidation at this value level.

Marty Occasion reported this on Elon Musk’s social media platform X, citing information from Coinglass. Concluding this disclosure, the crypto fanatic famous: “By no means wager towards know-how.”

How Lengthy For This Liquidation To Happen?

Whereas the $72,400 value mark would possibly appear to be an extended stretch from the present market value, BTC may not take that lengthy to get to this mark, given the present fundamentals. As an illustration, the market may be drawn faster to this mark as that is the place the liquidity lies to gas its present pattern.

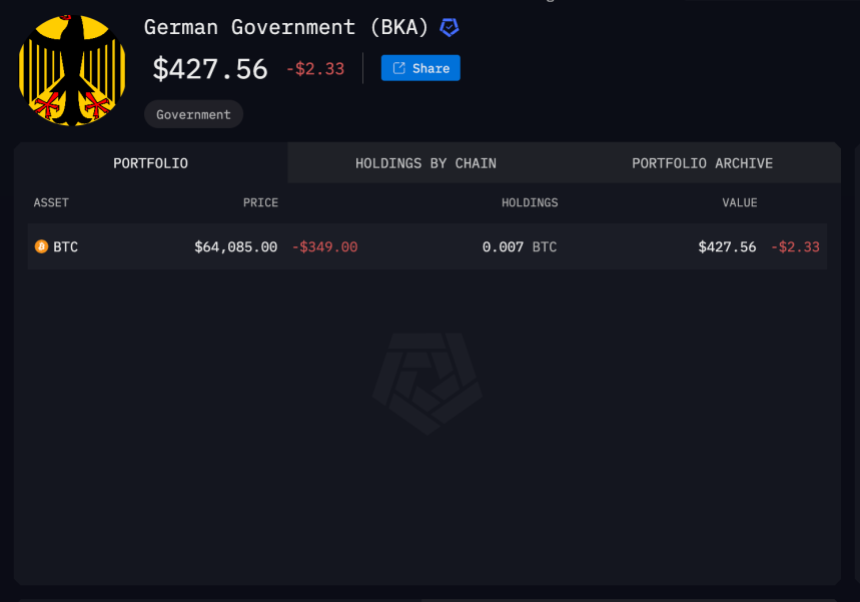

Except for that, no bears are in sight to gradual the asset’s rally from getting there within the brief time period. To start with, the German authorities has bought off all of its BTC holdings of roughly 49,858 BTC with a present steadiness beneath $500, in accordance with information from Arkham Intelligence.

Notably, the present steadiness of roughly $427 price of BTC is the cumulative sats (small items of BTC) donated from totally different pockets addresses. Moreover, in accordance with latest information from CryptoQuant, 36% of Mt. Gox BTC has been distributed to collectors.

Nevertheless, regardless of this distribution, BTC’s value is but to see any notable correction, which suggests two issues: that the collectors aren’t promoting, and even when they’re, the Bitcoin market is absorbing it actual rapidly as evident within the slight stabilization of BTC’s value.

Associated Studying

These main sell-offs by the German authorities and Mt. Gox, as soon as thought of main threats to the crypto market, now appear to have minimal impression, indicating that no vital bearish obstacles stop Bitcoin from surging to the $72,400 mark, creating a brief squeeze.

Featured picture created with DALL-E, Chart from TradingView