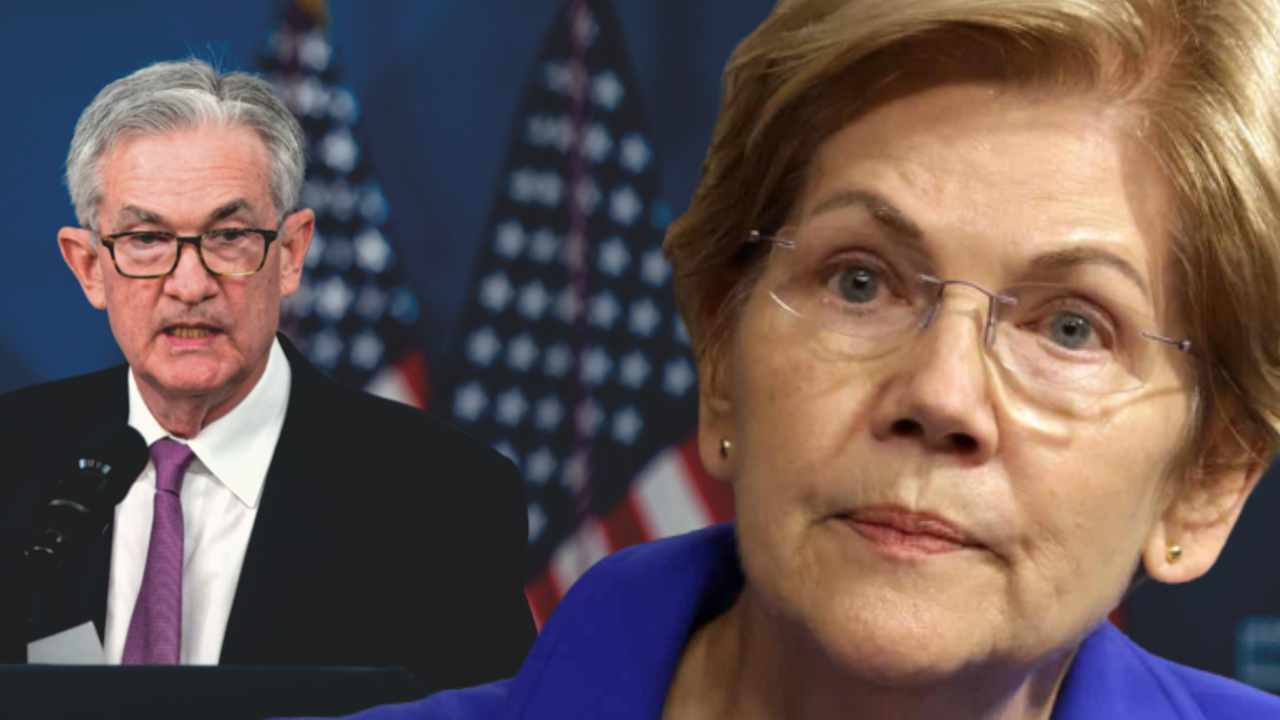

U.S. Senator Elizabeth Warren has known as for a “thorough, unbiased investigation of the causes” that led to the failure of Silicon Valley Financial institution (SVB) and Signature Financial institution. She alleges that Federal Reserve Chairman Jerome Powell “bears direct accountability” for regulatory and supervisory points involving the 2 banks.

Senator Elizabeth Warren Requires Impartial Investigation Into Financial institution Failures

U.S. Senator Elizabeth Warren (D-MA) known as for an investigation into the current collapse of main banks in a March 18 letter to the Treasury Division’s deputy inspector normal, the Federal Deposit Insurance coverage Company (FDIC)’s appearing inspector normal, and the Federal Reserve Board’s inspector normal.

“I’m writing to ask that you just instantly open a radical, unbiased investigation of the causes of the financial institution administration and regulatory and supervisory issues that resulted on this month’s failure of Silicon Valley Financial institution (SVB) and Signature Financial institution and ship preliminary outcomes inside 30 days,” the senator from Massachusetts wrote. SVB was closed down by regulators on March 10 whereas Signature Financial institution was seized by the New York State Division of Monetary Companies a few days later.

Warren confused:

These failures have been extraordinary occasions: they have been the second- and third-largest financial institution failures within the nation’s historical past.

She added that “till the Treasury Division, in session with the Federal Reserve and Federal Deposit Insurance coverage Company (FDIC), decided them to be ‘systemic threat’ and intervened to ensure billions of {dollars} of deposits,” these financial institution failures “threatened financial contagion and extreme harm to the banking and monetary programs.”

Whereas noting that “The financial institution’s executives, who took pointless dangers or didn’t hedge in opposition to totally foreseeable threats, have to be held accountable for these failures,” Warren claimed that “this mismanagement was allowed to happen due to a collection of failures by lawmakers and regulators.”

She additional alleged that Congress and former U.S. President Donald Trump “weakened” the Dodd-Frank Act and allowed banks like Silicon Valley Financial institution and Signature Financial institution “to evade key guidelines and laws.”

As well as, the lawmaker stated the Federal Reserve below Chair Jerome Powell “initiated regulatory rollbacks,” and the banks’ supervisors, significantly the Federal Reserve Financial institution of San Francisco that oversaw Silicon Valley Financial institution, “missed or ignored key indicators concerning the impending failure.” Warren emphasised: “These regulatory rollbacks created an setting wherein failure was inevitable.”

Senator Warren moreover instructed inspectors normal:

Additionally it is important that your investigation be utterly unbiased and freed from affect from the financial institution executives or regulators that have been answerable for motion that led to those financial institution failures.

“I’m significantly involved that you just keep away from any interference from Fed Chair Jerome Powell, who bears direct accountability for — and has an extended report of failure involving — regulatory and supervisory issues involving these two banks,” she cautioned.

Furthermore, Warren wrote: “Chair Powell muzzled regulators from any public point out of the regulatory failures that occurred below his watch. If these reviews have been true, they might reveal outrageous and inappropriate interventions by Chair Powell.”

In an interview with NBC Information Sunday, Senator Warren additional slammed the Federal Reserve chairman, stating:

He has had two jobs. One is to take care of financial coverage. One is to take care of regulation. He has failed at each … Look, I don’t assume he needs to be chairman of the Federal Reserve.

Warren additionally not too long ago blamed Silvergate Financial institution’s failure on crypto dangers and claimed that Signature Financial institution collapsed as a result of it embraced crypto shoppers with out ample safeguards.

What do you consider Senator Elizabeth Warren calling for an unbiased investigation into current financial institution failures and holding Fed Chair Jerome Powell accountable? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.