DeFi is a sport of narratives. Nonetheless, these narratives are continually altering, and the traits inside them constantly evolve. Maintaining with the most recent traits requires in-depth information of what these narratives are and the way they quickly evolve within the crypto market.

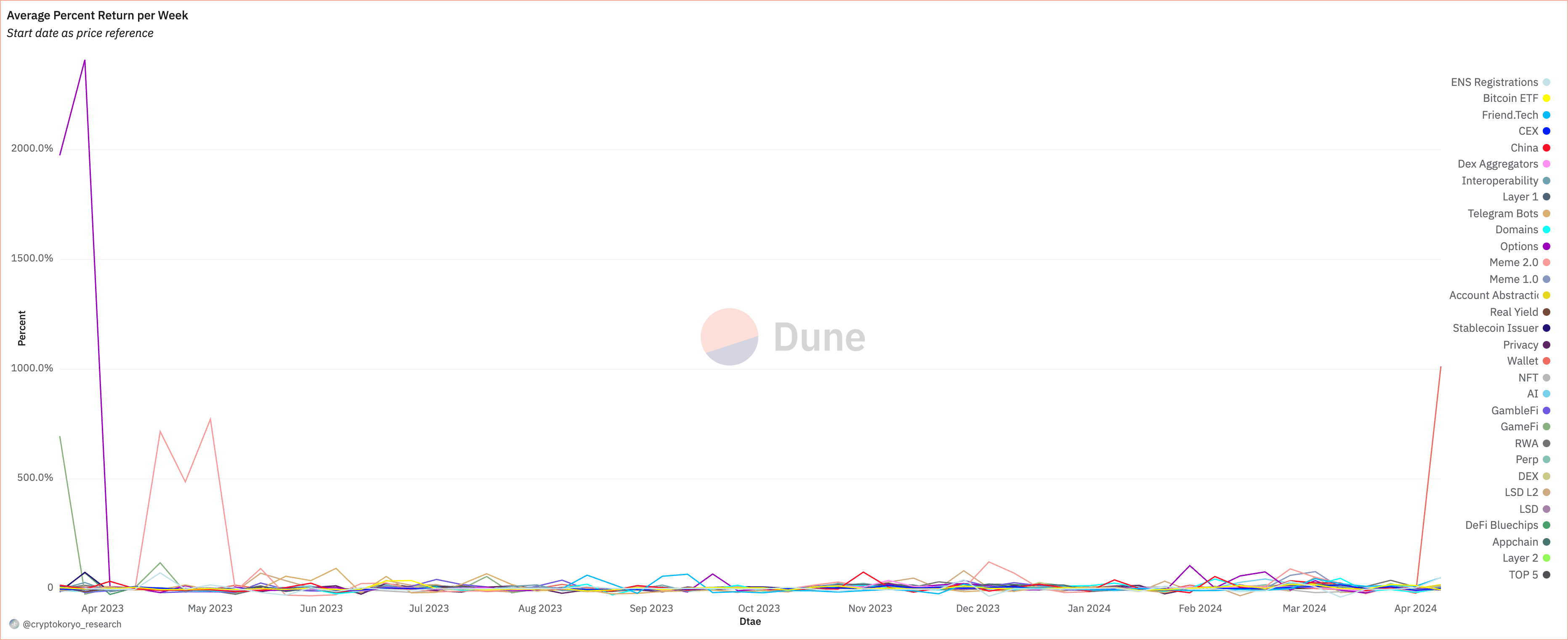

This evaluation is predicated on knowledge from Dune Analytics, particularly from @cryptokoryo, who was among the many first to group these narratives into quantifiable indices. Every index locations equal weighting on the highest 5 initiatives inside that exact narrative, creating an imperfect however extraordinarily helpful dataset for analyzing the DeFi house.

The unique knowledge recognized round 30 narratives, however a couple of have stood out as dominant because the starting of the 12 months. AI, encompassing AGIX, ALI, FET, OCEAN, ORAI, Pal.tech with Cobie, 0xRacerAlt, HsakaTrades, Banks, and Zhusu tokens; Memecoins with BONE, DOGE, ELON, FLOKI, SHIB, BOB, LADYS, PEPE, TURBO, and WOJAK tokens. The Bitcoin ETF narrative has additionally been distinguished this 12 months, with the index following the efficiency of BTC and BCH.

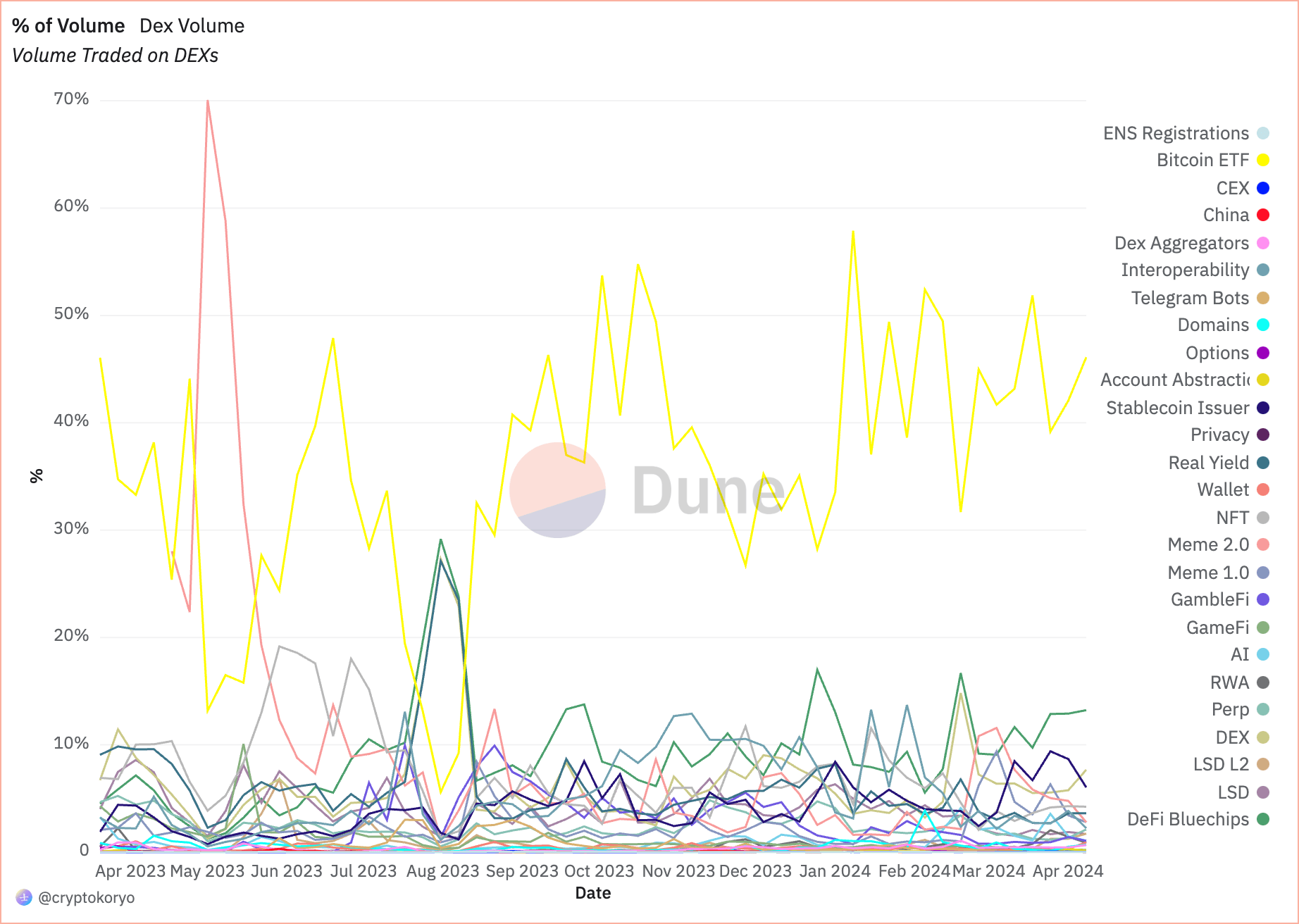

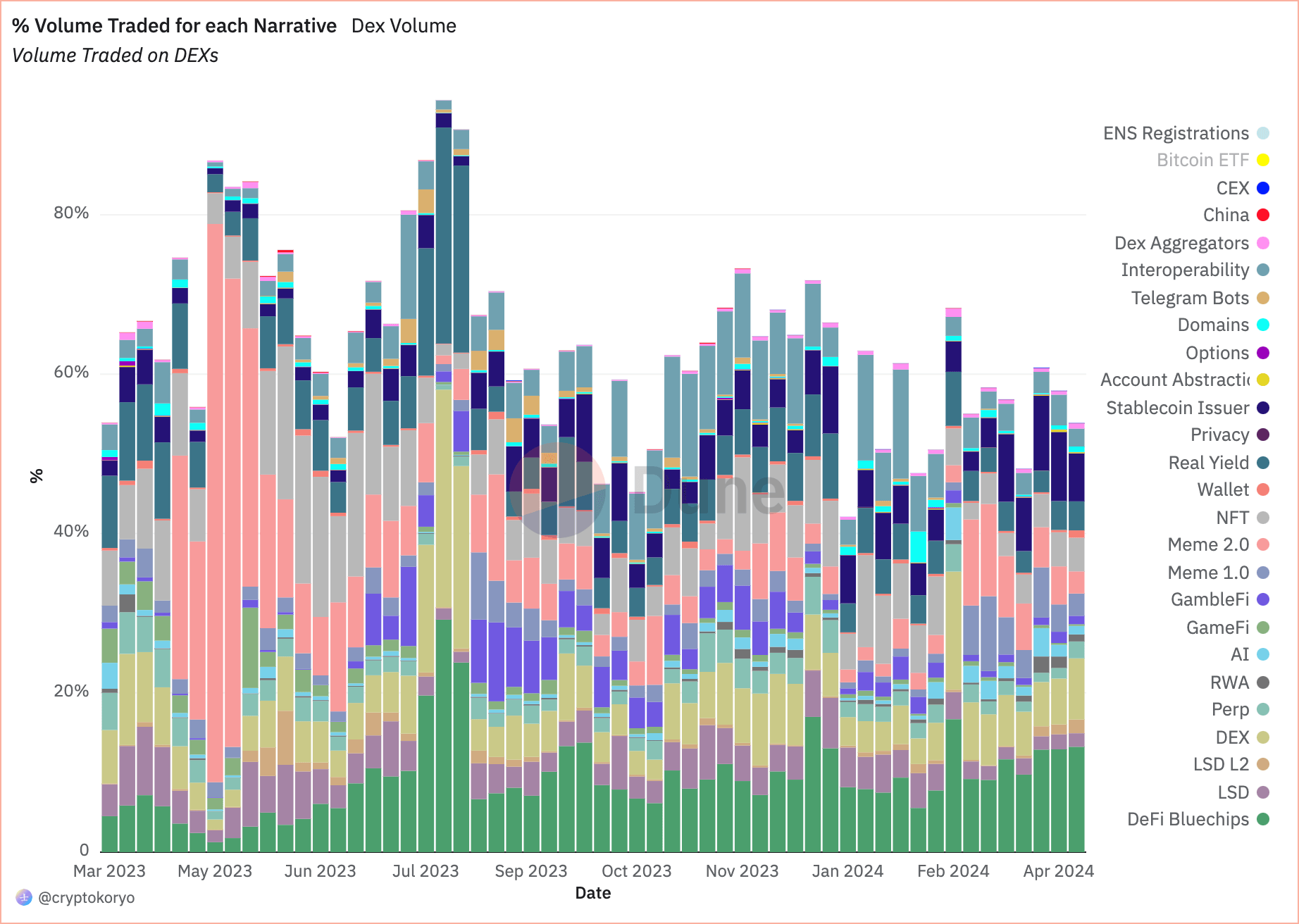

In terms of buying and selling quantity, the Bitcoin ETF narrative is unequalled. Information from Dune confirmed that BTC and BCH buying and selling quantity accounted for 46.1% of the overall buying and selling quantity throughout narratives on April 8.

Nonetheless, it is likely to be sensible to exclude BTC-related exercise from the remainder of the DeFi narrative as a very completely different set of things drives it.

Focusing solely on DeFi, we see that DeFi Bluechips (AAVE, COMP, CRV, MKR, and UNI) accounted for almost all of the buying and selling quantity.

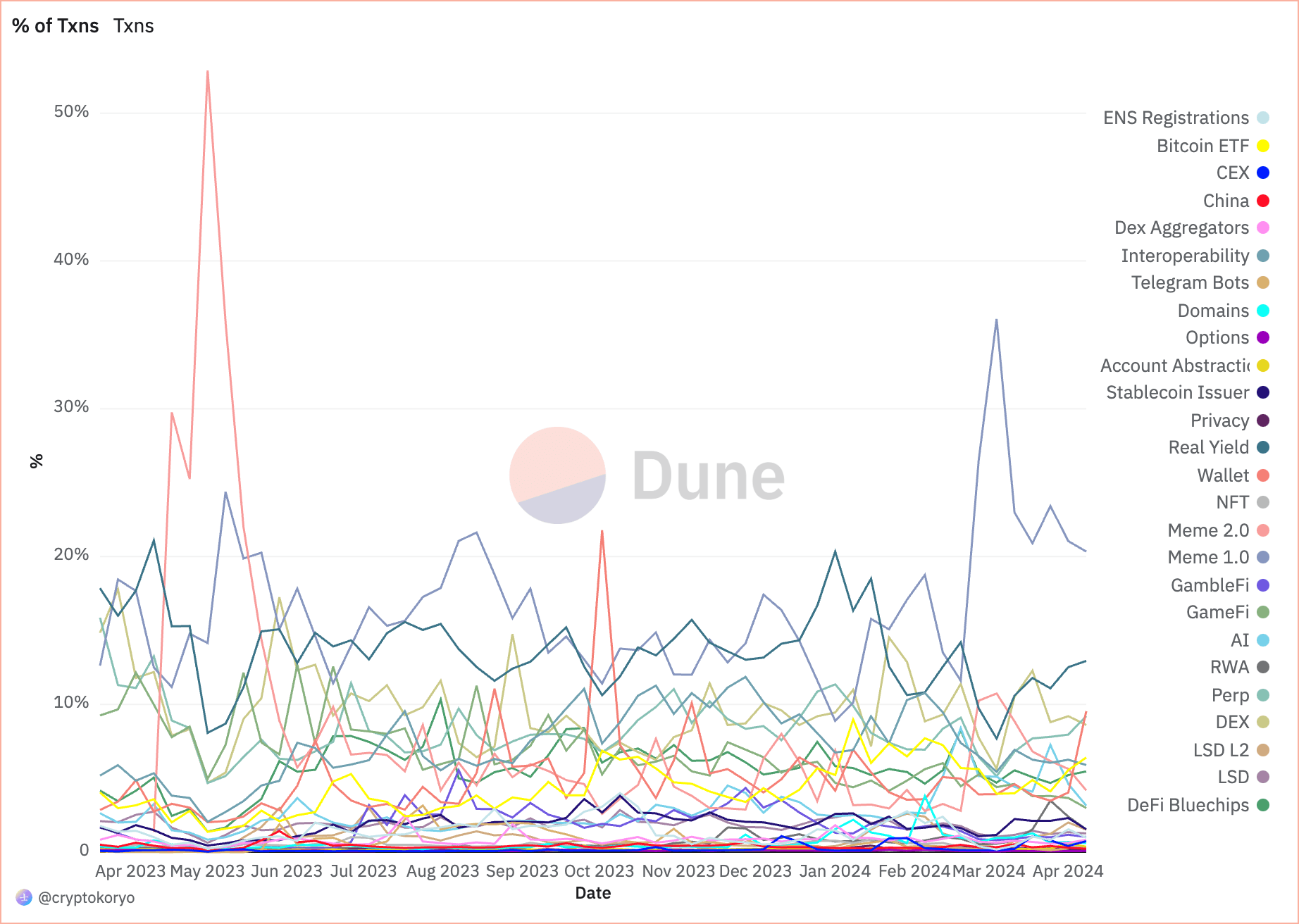

Relating to the overall variety of transactions, one narrative has been dominating for the higher a part of the final two months—memes. Extra particularly, the unique memecoin index that tracks the efficiency of BONE, DOGE, ELON, FLOKI, and SHIB. It peaked on April 3, accounting for 36.4% of the transactions from these narratives, and has persistently accounted for round 1 / 4 of the transactions since.

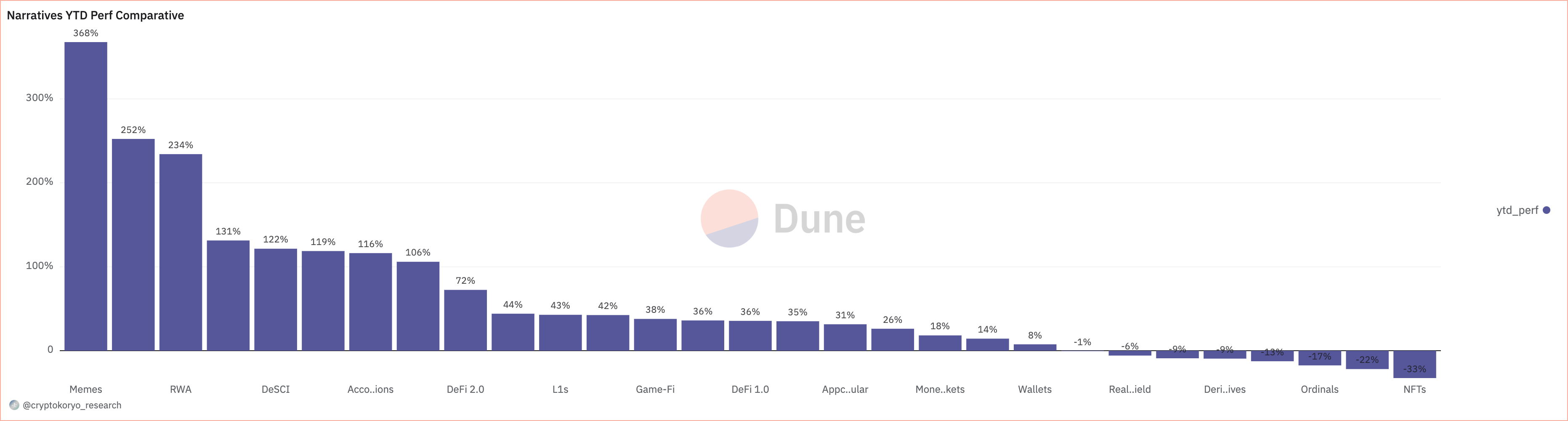

Trying on the year-to-date (YTD) efficiency of those narratives additional confirms memes’ supremacy. Memes have proven a 368% YTD return as of April 11, drastically outperforming the second-ranked narrative — layer-2 liquid staking tokens ASX, LBR, PENDLE, and TENET (252%).

Actual-world property (RWA), tokenized tangible property that exist in the true world, ranked third with a YTD efficiency of 234%. The worst-performing narratives this 12 months have been NFTs, with a YTD lack of 33%, whereas Gamble-Fi, with BCB, BETU, FUN, RLB, and WINR, trailed intently behind with a 22% YTD loss.

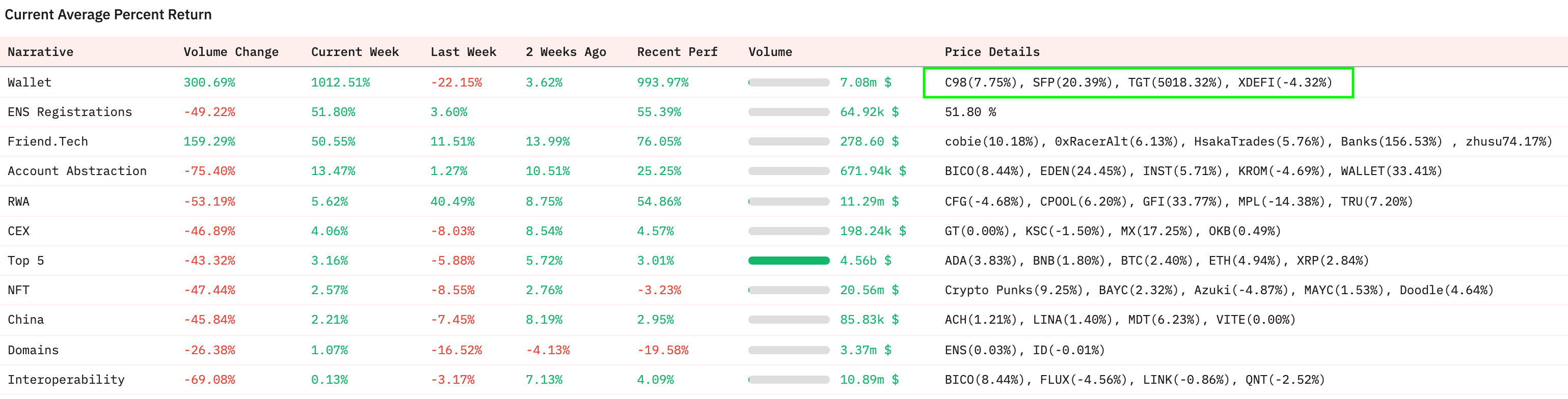

Whereas memes appear to be a long-term pattern this 12 months, a newcomer has the potential to shake up the DeFi narrative within the coming weeks: wallets. The index monitoring the efficiency of Belief Pockets Token (TWT), SafePal (SFP), Coin98 (C98), THORWallet (TGT), and XDEFI Pockets (XDEFI) confirmed a mean weekly return of 1,012% on April 8, propelling it to the highest of the crypto narratives.

Delving deeper into the narrative reveals that THORWallet’s native token, TGT, exhibited a 5,018% weekly return on April 8, whereas SafePal’s native token elevated by simply over 20%.

Though this definitely represents an anomaly, there’s a chance that wallets and their native tokens will proceed to maintain their recognition, albeit not at these ranges.

The second-highest rating narrative when it comes to weekly returns was ENS Registrations, which posted a 51.8% return throughout the identical timeframe. Pal.tech intently adopted with a 50.55% weekly return, exhibiting a way more sustainable trajectory in latest weeks.

The DeFi house is a testomony to the ever-evolving nature of the crypto market, with narratives shaping and reshaping the course of pursuits and cash circulate.

Whereas “conventional” property like these included within the Bitcoin ETF narrative proceed to command nearly all of consideration and buying and selling quantity, newer narratives, significantly these specializing in DeFi-native use instances and purposes, are usually not far behind.

The extraordinary efficiency of memes this 12 months reveals the market’s unsatiable urge for food for hypothesis. This urge for food is additional fueled by social media and its affect on the retail phase of the market. Nonetheless, the rise in pockets tokens appears to sign a rising curiosity in infrastructure and instruments that, at the very least on paper, improve safety and person expertise. This, alongside the fluctuating fortunes of NFTs and Gamble-Fi narratives, appears to point out a younger however promising transfer in the direction of worth and sustainable fashions inside the DeFi house.

Within the coming months, the power to anticipate and adapt to those narrative shifts shall be essential for anybody collaborating within the DeFi market. The insights gleaned from analyzing these traits not solely provide a glimpse into the present state of the market but additionally trace on the future course of DeFi innovation and funding.

The submit Shifting DeFi narratives: Memes soar as wallets place for dominance appeared first on CryptoSlate.