Fast Take

An information evaluation snapshot from Bitcoin Munger presents an fascinating nuance within the monetary panorama.

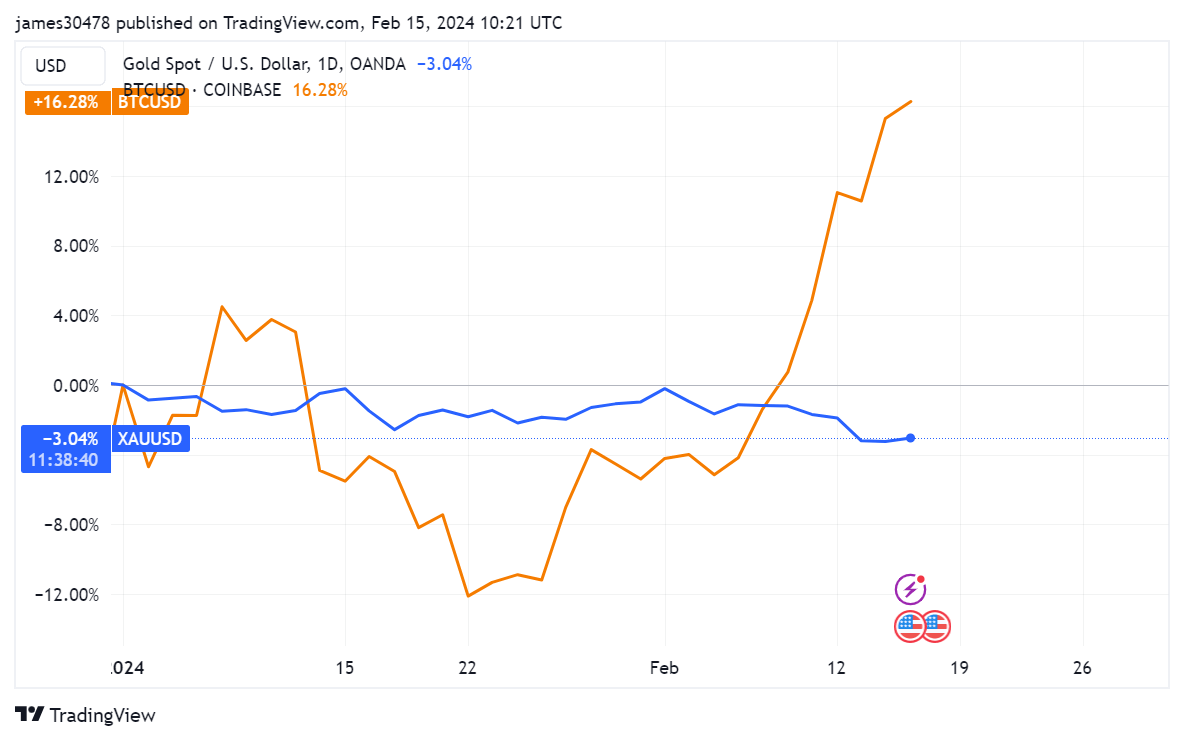

Traditionally thought-about a secure haven asset, Gold has skilled vital outflows from its ETFs. Bloomberg’s chart exhibits a downward pattern, with roughly $3 billion outflows from varied gold ETFs YTD and roughly $9 billion over the previous 12 months. Particularly, SPDR Gold shares and iShares Gold Belief witnessed about $2.5 billion and $500 million outflows YTD, respectively, with gold costs dropping 3% YTD.

On the opposite finish of the spectrum, Bitcoin’s efficiency stands out. Recording an upswing of 16% YTD, the digital asset has seen an influx of $4.1 billion from ETFs, a outstanding feat contemplating these ETFs solely began buying and selling on Jan. 11.

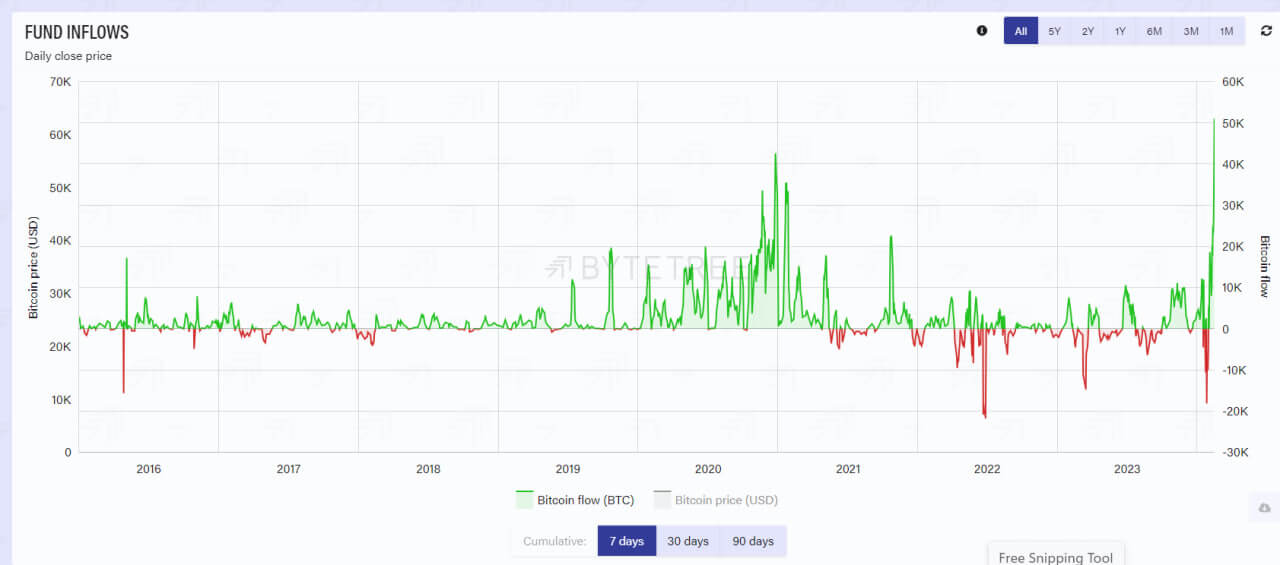

Additional supporting Bitcoin’s bullish run, the previous week noticed a report addition of 51,000 Bitcoin to world ETPs. Though these ETPs are round 40,000 BTC from their all-time excessive, they presently maintain 922,000 Bitcoin, in accordance with Byte Tree.

Benchmarking in opposition to gold, Bitcoin’s current crossing of the $1T asset mark is noteworthy, particularly in opposition to gold’s $13T. This pattern might recommend a shifting choice amongst traders, reinforcing the narrative of Bitcoin as ‘digital gold.’

The put up Bitcoin ETFs entice $4.1 billion amid $3 billion gold outflows appeared first on CryptoSlate.