The buy-now-pay-later business continues to develop in recognition. And a part of the reason being customers are beginning to perceive that the majority of BNPL stands exterior the normal credit score scoring system.

The Wall Road Journal reported this previous weekend on the brand new development of customers making common purchases like groceries and different necessities utilizing BNPL. A part of the explanation for that is to keep away from having these transactions reported to the credit score bureaus as they might be in the event that they used a bank card.

Whereas the credit score bureaus gave BNPL corporations the choice of reporting their transactions to the bureaus most are selecting not to take action. To be truthful, the credit score bureau system just isn’t actually arrange for these Pay in 4 transactions given how rapidly these “loans” are paid off.

Extra week must be accomplished. BNPL is right here to remain and regulators just like the CFPB have indicated they’re preserving a detailed eye on the business. However not a lot has been accomplished on this space but.

This is among the many causes that money stream underwriting is gaining in recognition for client lenders however that may be a story for an additional day.

Featured

Purchase Now, Pay Later Retains Folks Spending—With out Credit score Businesses Figuring out

Shoppers are flocking to installment loans for all the things from vacation items and groceries to laser eye surgical procedure.

From Fintech Nexus

> Melio, J.P. Morgan unite to ship RTP B2B funds

By Tony Zerucha

Due to enhancements in expertise, progressive companies like Melio are bringing B2B funds into the twenty first century. This week, Melio launched Actual-Time Funds, supported by J.P. Morgan.

> Nubank provides stablecoin USDC, boosts crypto providing in Brazil

By David Feliba

Nubank, the most important neobank in Latin America, will introduce USDC to its Brazilian purchasers, a big development for the stablecoin.

Podcast

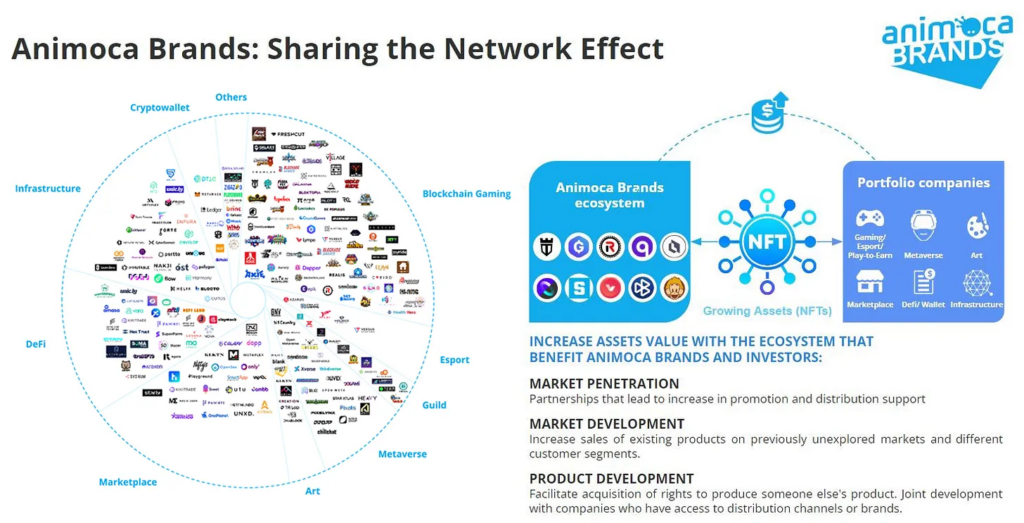

How Animoca Manufacturers constructed an empire on the intersection of Gaming and Finance, with Animoca Manufacturers Chairman Yat Siu

Hello Fintech Architects, Welcome again to our podcast collection! For people who wish to subscribe in your app of selection, you’ll be able to…

Additionally Making Information

- USA: Scout’s honored to assist: Meriwest Union launches a digital assistant known as Scout

With $2.3 billion in belongings, 80,000 members, and eight California-based branches, Meriwest Union has launched its personal digital assistant known as Scout. The digital assistant is the credit score union’s try to pad out its digital providing since its digital banking members have been yielding 67% extra revenue than those that most well-liked in-person channels.

To sponsor our newsletters and attain 220,000 fintech lovers along with your message, contact us right here.