Parabolic Cease and Reverse is a technical evaluation instrument that quite a lot of energetic merchants could discover helpful. It’s favored by futures merchants that need to all the time have a place open.

PSAR, parabolic cease and reverse, is among the extra advanced indicators. It was initially meant to be used within the futures market however like most good buying and selling instruments is relevant to any type of buying and selling with a chart of costs. The unique use was for hedging positions. Some futures buying and selling, these whose job it’s to purchase and promote bodily commodities not simply speculators, requires a place to be open on a regular basis to hedge towards future value fluctuations. In case of those professionals, when a bullish place is closed a bearish place should be opened and vice versa. The issue of figuring out when to open and shut these positions may be solved, at the very least in principle, with the assistance of PSAR.

The indicator was developed by J. Welles Wilder jr. and takes value motion in addition to time decay into consideration throughout the equation. It shows as a dot above or beneath every intervals value motion and is used as assist/resistance targets and for entry and exit alerts.

A futures dealer would comply with its alerts like this: when the dots are under the candlesticks lengthy positions are opened. When costs transfer under a dot the development is reversed and merchants think about opening brief positions. Every time the dot switches sides a brand new place is opened. An choices, foreign exchange or CFD dealer might open a place with every change though this isn’t all the time the most effective method. Many occasions massive parts of the transfer have already occurred, particularly if you’re utilizing a brief time period time-frame, so ready for pull backs/reduction rallies and assessments of assist/resistance is normally a good suggestion. Targets for this assist/resistance is the PSAR.

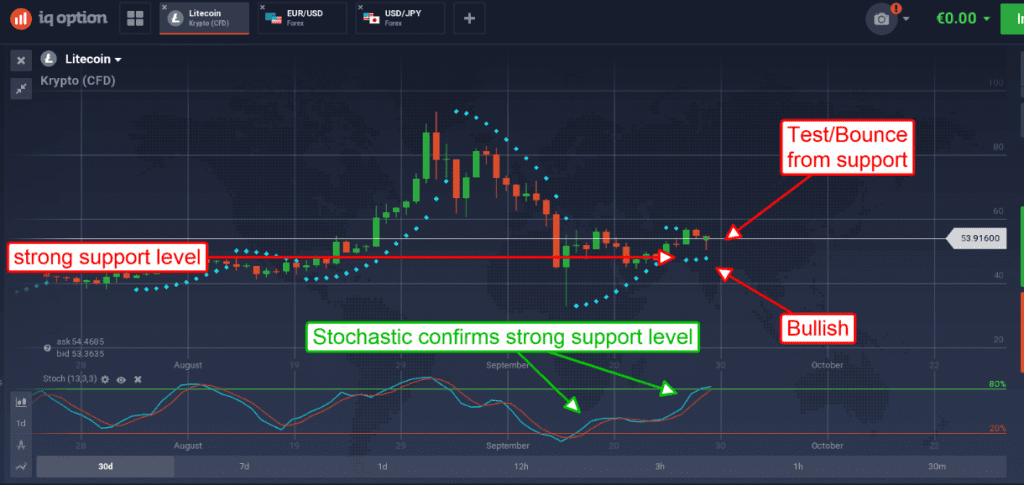

The indicator, like all others, is a chilly and heartless one giving each bull and bear alerts in both form of market. This is the reason some type of extra evaluation is required to weed out false and fewer possible buying and selling alerts. On this occasion a a number of time-frame method with PSAR might work, some merchants additionally favor so as to add stochastic to the combo. On this occasion we’ll use the day by day chart and PSAR to set the buying and selling path for right now after which transfer all the way down to an hourly or 30 minute chart and stochastic for entry alerts. Within the chart above you possibly can see that Litecoin is buying and selling above its dot which makes right now a bullish day. As well as, the present candle has already moved down to check assist and confirmed. We then transfer all the way down to the hourly chart to attend for entry alerts for getting calls or opening lengthy positions.

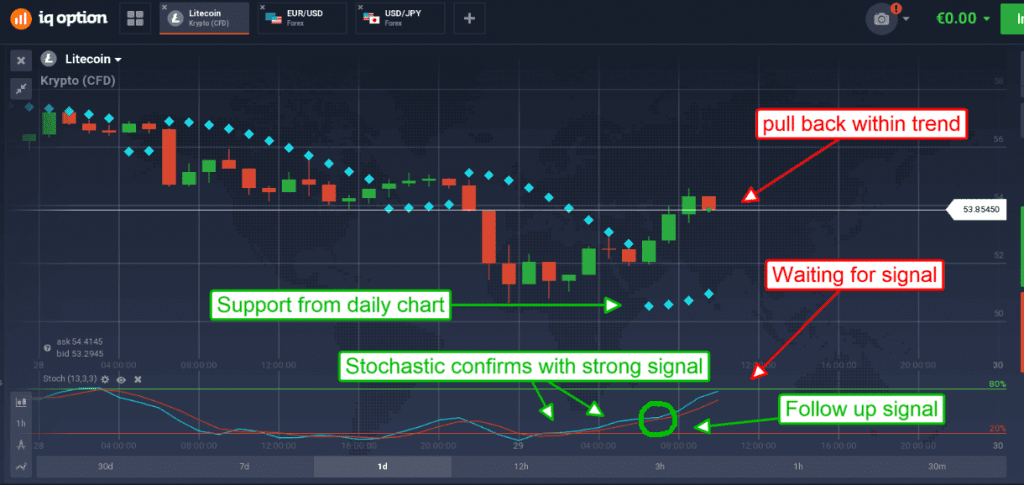

The chart under reveals an asset already in rally mode, having bounced up from assist. This transfer is confirmed by a powerful entry sign in stochastic which continues to be on the rise and transferring towards the higher sign line.

Presently the factor to do is watch for the subsequent stochastic sign as a result of there may be already one in play, entry right here is questionable. The following stochastic sign can be a bullish crossover or any dip of %Okay to check/bounce from %D. Bullish crossovers embody %D crossing the higher sign line or %Okay dipping under after which crossing again above %D. The period of the sign could possibly be as brief as 1 hour or so long as a number of days, relying on market situations.

[cta_en link=”https://iqoption.com/lp/ultimate-trading/?aff=88&aftrack=active1802″ name=”Trade here”][/cta_en]