NEAR Protocol, a Blockchain Working System (BOS), demonstrated notable development within the third quarter of 2023, defying the difficult circumstances of the general cryptocurrency market.

In accordance with a current report by Messari, key metrics for NEAR Protocol surged considerably over the previous month, buoyed by current value will increase throughout the crypto market.

Surge In Transactions Drives Income Development For NEAR

Per the report, regardless of a average downturn within the crypto market, with XRP and Grayscale going through courtroom rulings of their favor, NEAR Protocol showcased resilience. The overall crypto market capitalization dipped by 5.8%, with Bitcoin (BTC) and Ethereum (ETH) experiencing declines of seven.5% and 10.0% respectively.

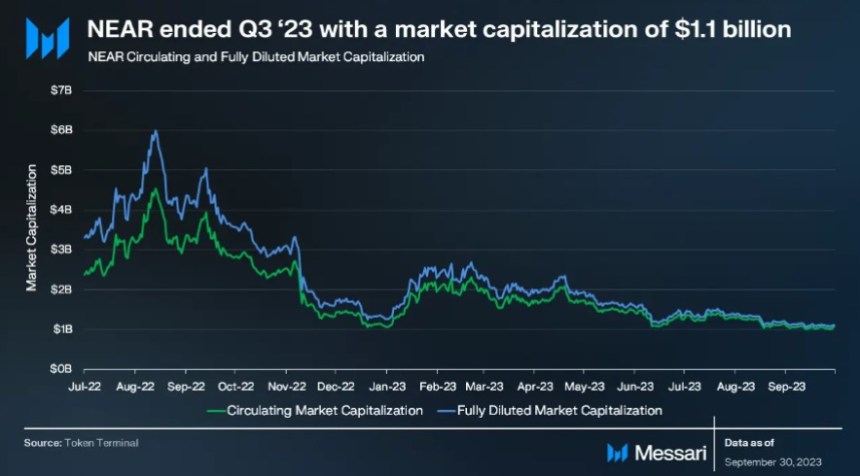

Inside this context, NEAR’s circulating market capitalization decreased by 14% quarter-over-quarter (QoQ) to $1.08 billion, whereas its totally diluted market capitalization decreased by 17% QoQ to $1.12 billion.

Nonetheless, NEAR Protocol maintained its place because the fortieth largest crypto protocol by market capitalization by the top of the quarter.

One of many highlights in Q3 ’23 for the protocol was the income development, which elevated by 9% QoQ from $98,000 to $108,000. The typical transaction charge remained at a low $0.001 all through the quarter.

Relating to community exercise, NEAR recorded substantial development in addresses throughout Q3 ’23. Lively addresses elevated by 350% QoQ, reaching 260,000 each day lively addresses, whereas new addresses noticed a 274% QoQ improve, totaling 51,000 each day new addresses.

This development was primarily fueled by the launch of KAIKAINOW, NEAR’s main utility, and supported by contributions from the Web3 well being and health app, Sweat Financial system, and Aurora, an answer that enables the execution of Ethereum contracts in a “extra performant atmosphere” within the NEAR ecosystem.

TVL Drops To $52 Million In Q3 2023

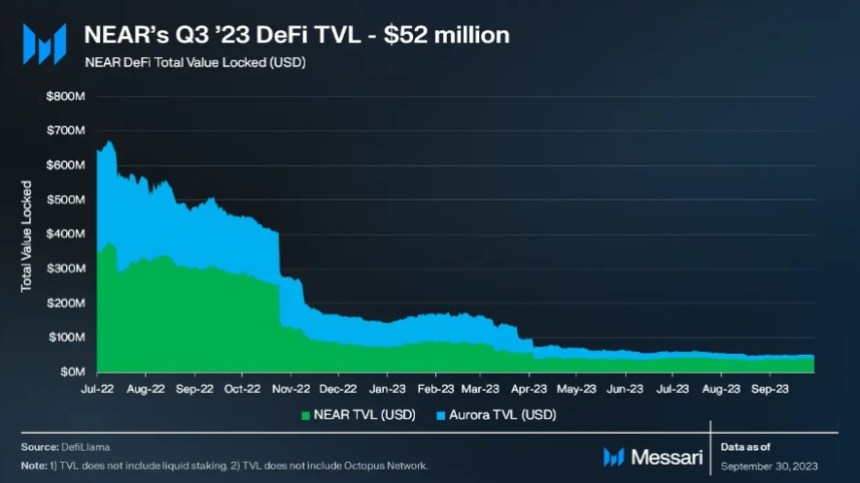

In accordance with Messari, NEAR’s Whole Worth Locked (TVL) skilled a 13% QoQ lower, amounting to $52 million by the top of the quarter. NEAR ranked roughly thirty fifth amongst blockchains by way of TVL.

Inside the NEAR Community’s TVL, NEAR’s contribution accounted for $41 million (80%), whereas Aurora contributed $11 million (20%).

Relating to DEX buying and selling quantity, NEAR reported a median each day quantity of $1.3 million, sustaining stability in comparison with the earlier quarter. NEAR ranked roughly thirtieth amongst DEX buying and selling volumes.

NEAR’s stablecoin market capitalization skilled a 27% QoQ decline, primarily pushed by reductions in USDC and USDT. Nevertheless, the native USDC was launched on NEAR throughout this era, whereas USN, the winding-down stablecoin from Decentral Financial institution, remained unchanged.

NEAR Token’s Bullish Momentum Continues

Relating to value motion, as noticed within the 1-day chart beneath, NEAR Protocol’s token, NEAR, has damaged a protracted downtrend that commenced on July 20 and concluded on August 18, resulting in a section of accumulation.

Nevertheless, on October 19, the token initiated an uptrend, leading to important features of 12% over the past 30 days, 22% inside the fourteen-day timeframe, and 22.3% previously week. Presently, the token continues its rally, exhibiting a 2.6% surge previously 24 hours, bringing the present buying and selling value to $1.23.

When contemplating the year-over-year interval, the token stays considerably beneath its excessive in 2022, experiencing a decline of 60% over this length. Moreover, for NEAR to reclaim its 2023 yearly excessive, which stood at $2.83 and was achieved in April, the bullish momentum should persist.

It stays to be seen whether or not the token can maintain its present bullish momentum and set up a brand new yearly excessive, capitalizing on the rallies witnessed by the biggest cryptocurrencies available in the market within the upcoming months to generate additional income.

Featured picture from Shutterstock, chart from TradingView.com