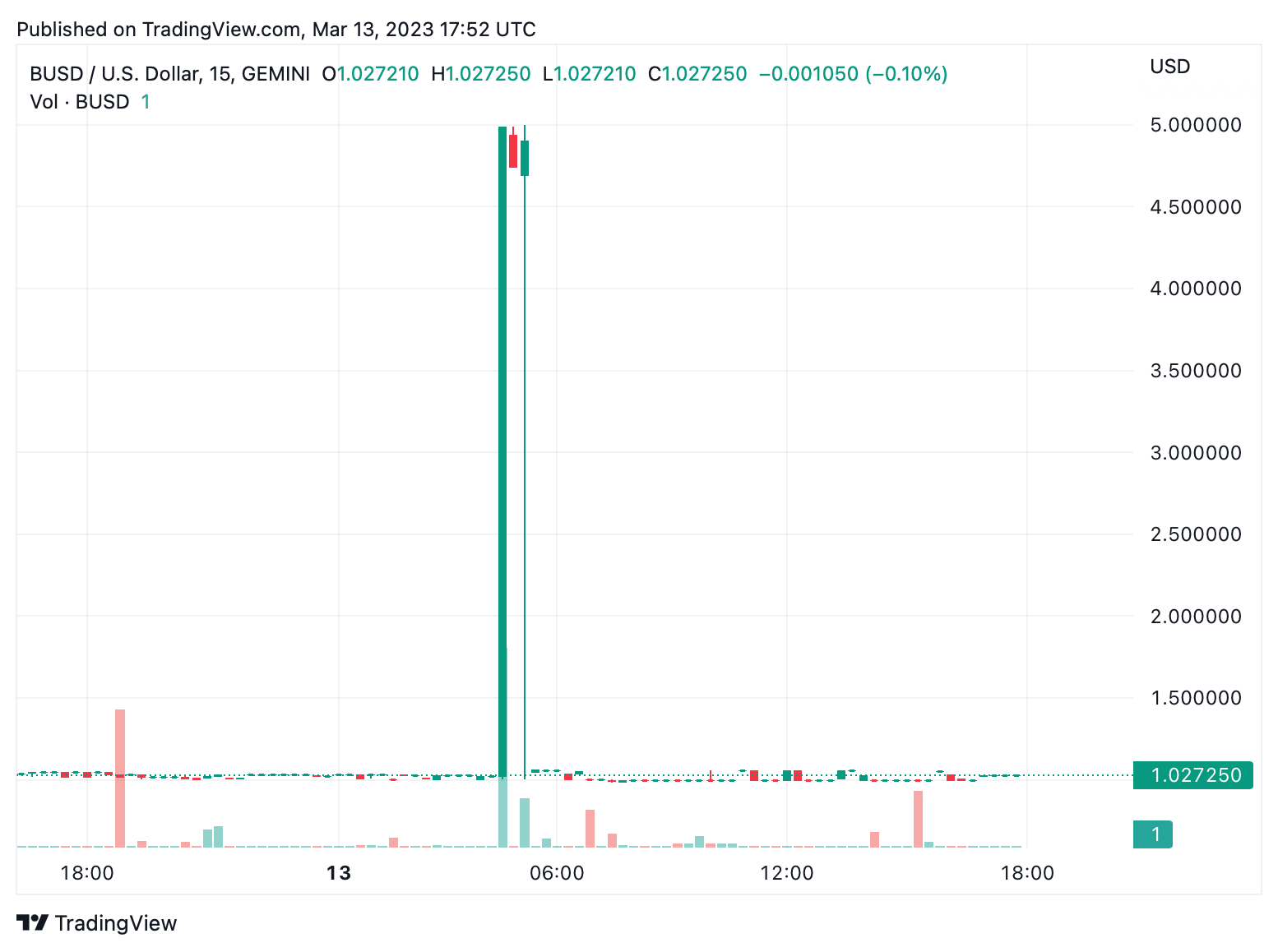

On Monday, the crypto economic system skilled important market exercise with $183.85 billion in international commerce quantity over 24 hours, with a big portion of these trades involving stablecoins. USDC traded close to parity with the U.S. greenback, and a number of other stablecoins, together with tether and BUSD, bought at premiums. Tether reached a excessive of $1.04 per unit and BUSD rose to $1.03 per coin through the morning buying and selling periods (ET).

Small Handful of Stablecoin Belongings Commerce for Premiums as USDC Closes $1 Parity Hole

On Monday, stablecoins skilled important commerce volumes after USDC had problem sustaining its peg to the U.S. greenback over the weekend. This brought about 5 different stablecoins to depeg just under the $1 worth. At present, USDC has nearly closed the hole and is buying and selling at $0.99 per coin, however merchants trying to trade USDC for tether (USDT), binance usd (BUSD), or one other stablecoin could must pay a premium.

At present, tether (USDT) is buying and selling at two cents above the U.S. greenback, with an early morning buying and selling worth of $1.04 per coin. Some tether (USDT) spikes went as excessive as $1.076 per USDT on Monday. BUSD noticed an identical premium at $1.03 per unit, and different stablecoins, reminiscent of TUSD and DAI, are additionally experiencing increased costs primarily based on the trade utilized by merchants. At $1.02 per unit and with 72.55 billion USDT in circulation, the extra two cents brings USDT’s market cap as much as $74.23 billion on the time of writing.

Of the $183.85 billion in international commerce quantity, USDT accounts for $94.27 billion or 51.27% of the amount. USDC has a worldwide commerce quantity of $10.79 billion, representing 5.87% of the $183 billion in trades over the past 24 hours. Bitcoin (BTC) and ethereum (ETH) have additionally captured a major quantity of the day’s buying and selling quantity. Bitcoin (BTC) rose 16.6% towards the U.S. greenback on Monday and noticed $70.22 billion in swaps, whereas ethereum (ETH) elevated 12.9% and instructions $68.13 billion in international buying and selling quantity.

With the small premiums and USDC returning to $1 parity, the market capitalization of the stablecoin economic system is presently $136.25 billion. Whereas stablecoin premiums and this weekend’s depegging occasion might not be helpful for some merchants, the discrepancies profit stablecoin arbitrageurs considerably. Moreover, Curve, the decentralized trade (dex) centered on stablecoin buying and selling, has recorded $1.02 billion in commerce quantity and is the second-largest dex by commerce quantity on Monday.

What are your ideas on the present stablecoin market and the impression of current premiums and depegging occasions on merchants and traders? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.