Prime Belief, LLC, a outstanding participant in digital asset custody, has filed voluntary petitions for Chapter 11 chapter.

In line with a report launched by the corporate on Aug. 14, the proceedings are anticipated to offer a “clear and value-maximizing course of for the advantage of its shoppers and stakeholders.”

The Nevada-based firm is understood for its modern providers in digital asset administration. As reported on July 18, Nevada courts ordered Prime Belief into non permanent receivership, signaling the intense monetary difficulties it confronted.

The corporate’s monetary deficit in July reportedly exceeded $82 million. As of the Chapter 11 submitting, the consolidated listing of the highest 50 unsecured collectors totals $144 million.

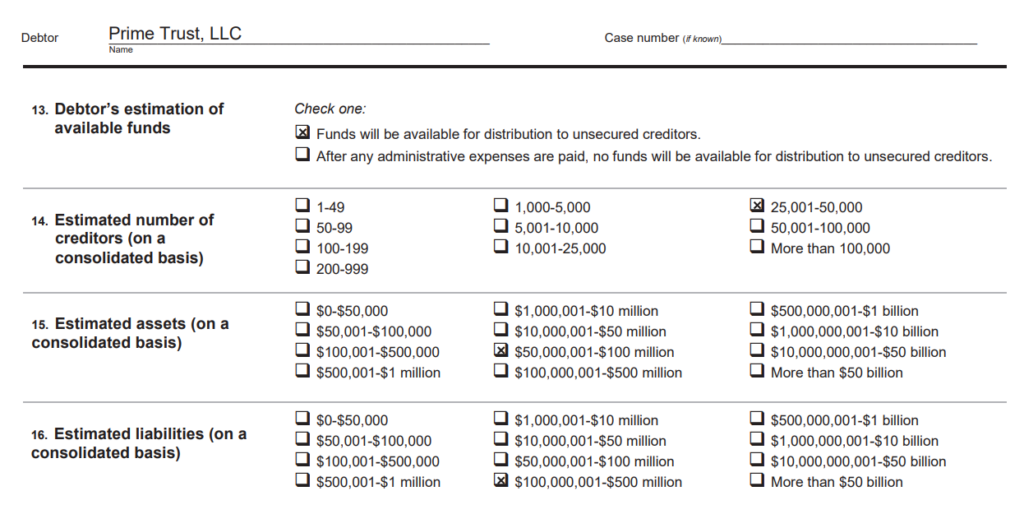

Additional, throughout 4 filings for Prime Belief group firms, Prime Core Applied sciences Inc., Prime Digital, LLC, Prime IRA LLC, and Prime Belief, LLC, there are liabilities recorded to be $100 million and $500 million, and property between $50 million and $100 million.

The potential impression on the business could possibly be important, given its pivotal function in offering custodial providers to institutional crypto traders.

Prime Belief is a ‘certified custodian,’ that means that every one buyer custodied property needs to be protected against the chapter of the custodian. CryptoSlate has reached out to Prime Belief for affirmation however has but to obtain a response as of press time.

Chapter 11 choice.

The choice to file for Chapter 11 chapter follows the everlasting appointment of former banking govt John Guedry as receiver for the corporate. Guedry, together with John Wilcox and Michael Wyse, kind a particular restructuring committee with the authority to supervise the corporate’s ongoing chapter circumstances.

As the corporate continues to function as “debtors-in-possession,” it intends to file a number of motions with the Chapter Courtroom to facilitate the “orderly analysis of all strategic alternate options.” These measures might probably embody promoting the corporate’s property and operations as a going concern.

Prime Belief’s monetary disaster, initiated almost a month earlier than the receivership order, has ripple results throughout the crypto business.

It started with the Nevada Monetary Establishments Division (NFID) issuing a stop and desist order on June 21 because of the firm’s lack of ability to satisfy buyer withdrawal requests.

This was shortly adopted by the chapter declaration of Prime Belief subsidiary Banq on June 14 and the termination of BitGo’s deliberate acquisition of Prime Belief on June 22.

Additional particulars associated to the court-supervised proceedings will likely be made obtainable because the proceedings unfold. They are often accessed on the DDebtors’restructuring web site.