The cryptocurrency market has skilled a interval of stagnation, with Bitcoin (BTC) buying and selling inside a slender vary for the previous week.

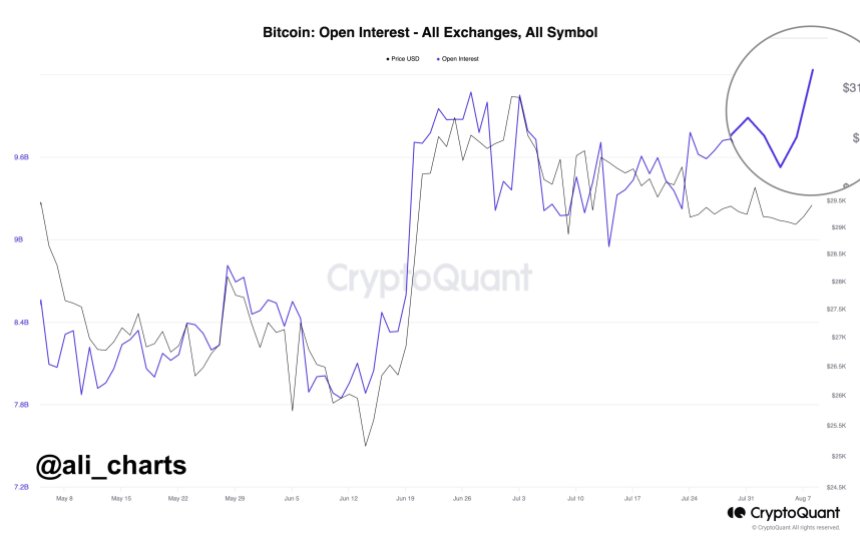

Nevertheless, in accordance to market analyst Ali Martinez, there’s a glimmer of hope on the horizon as Open Curiosity, a key indicator of market sentiment, has skyrocketed to a year-to-date excessive.

Correlation Between Open Curiosity And Bitcoin

Notably, the correlation between Open Curiosity and Bitcoin’s value has traditionally been important, suggesting that this surge might herald a possible reversal within the main cryptocurrency’s fortunes.

Martinez believes the current dip to $28,700 prompted crypto merchants to take lengthy positions, fueling optimism for a Bitcoin resurgence.

Over the previous week, the general crypto market has skilled a interval of stagnation, with Bitcoin buying and selling inside a good vary of $28,900 to $29,200.

This consolidation follows a steady decline from its yearly excessive of $31,800, which has additionally set the tone for different main cryptocurrencies. The dearth of great value motion has left traders and merchants anticipating a catalyst that would propel the market ahead.

Nonetheless, the variety of open lengthy and quick positions on crypto spinoff exchanges has surged to a exceptional year-to-date excessive of $10.086 billion. This surge in Open Curiosity is critical, indicating heightened market exercise and dealer engagement.

One essential facet to contemplate is the historic correlation between Open Curiosity and the value of Bitcoin. This relationship has typically been robust, with Open Curiosity as a number one indicator for potential value actions.

As Open Curiosity reaches new highs, it means that market contributors are actively taking positions in anticipation of a major market shift.

Whereas the crypto market has been characterised by stagnation and decline in current instances, the surge in Open Curiosity to a yearly excessive supplies hope for a bullish reversal.

Bearish Divergence Alerts Potential Pullback For BTC

Bitcoin has just lately exhibited some intriguing patterns that warrant consideration from each technical evaluation and on-chain evaluation views.

In accordance to Baro Digital, CryptoQuant writer and analyst, a bearish divergence on the BTC Common Return Index suggests a potential pullback to $26,000.

Concurrently, on-chain evaluation signifies a weakening return index efficiency alongside a rising Bitcoin value, doubtlessly signaling a part of re-accumulation that will profit traders looking for decrease costs.

The transition of the return index into the adverse zone suggests a shift in market sentiment in the direction of re-accumulation.

Re-accumulation sometimes happens when long-term traders or establishments purchase Bitcoin at decrease costs, anticipating future value appreciation. This conduct will be seen as a constructive signal for the market’s long-term well being, reflecting elevated curiosity from strategic traders.

As of the present replace, BTC has damaged out of its vary which has endured because the starting of August. It’s buying and selling at $29,600, reflecting a 2.5% enhance over the previous 24 hours.

Nevertheless, the upward value motion of BTC within the quick time period will not be sustained until accompanied by substantial buying and selling quantity. A number of important resistance ranges lie forward, posing challenges for BTC’s try to reclaim the $30,000 milestone.

To start with, the $29,700 zone presents a formidable barrier, adopted by subsequent resistance partitions at $30,000, $30,700, $31,200, and $31,500. Within the quick and mid-term, BTC, the most important cryptocurrency available in the market, will want a compelling catalyst to push past these ranges. With out such, a retracement is feasible within the coming weeks.

Featured picture from iStock, chart from TradingView.com