Terra Luna has seen the profitable approval of group proposals 11658 and 11660, authorizing the retrieval and subsequent incineration of a complete of 800 million USTC. The prevailing sentiment throughout the group leans in direction of directing these USTC tokens in direction of the burn deal with versus reintegrating them into the group pool.

Conversely, a noteworthy shift has been detected in LUNC’s staking ratio throughout the previous day, the place a earlier upward trajectory has now given strategy to a decline. This alteration within the staking ratio generally signifies lowered assurance amongst stakers relating to a selected asset.

Right here’s what’s occurring throughout the struggling Terra group:

Current Group Choices Form Terra Luna Future

In a major flip of occasions, Proposal 11658 titled “Return of Group funds not used,” offered by Vegas, a former member of the ex-Terra Rebels developer group, has achieved approval with an affirmative vote share of 70.27%.

And plainly as soon as once more.somebody is preventing towards us… So the 200 milion ustc that RH have “missed” used.. is likely one of the causes that I used to be so vocal to not ship all the remainder of the funds to the CP. Now appears that’s already moviments asking the signers to not do,the 11658…

— Vegas (@VegasMorph) August 8, 2023

Vegas has advocated for the reintegration of 800 million USTC on-chain funds again into the Terra Luna Basic group pool. This proposition stems from the commentary that the Ozone Protocol challenge is presently deviating from the proposed improvement plan.

In a parallel improvement, Proposal 11660, labeled “Burn 100% of Funds Ought to Prop: 11658 Go,” has garnered substantial assist, amassing a “Sure” vote share of 82.55%. This counter-proposal asserts {that a} substantial section of the group is advocating for the incineration of the 800 million tokens.

Consequently, even when Proposal 11658 is ratified, the counter-proposal is poised to take priority resulting from its larger vote rely.

Complete crypto market cap reaches $1.12 trillion at the moment. Chart: TradingView.com

Awaiting the group’s consideration is one other proposal, suggesting the burning of 80% of the funds whereas allocating the remaining 20% to the group pool designated for builders. Notably, this proposal has encountered restricted favor, with solely 46% of the group displaying settlement.

The aftermath of those current updates has naturally sparked curiosity relating to their influence on the value dynamics of LUNC. How are these choices influencing the valuation of the token?

Staking Confidence Wanes As LUNC Faces Worth Challenges

Bringing the latest developments to the forefront, there was a notable lower within the share of LUNC staked throughout the previous 24 hours. This shift signifies that holders and customers are opting to un-stake their holdings, signifying a diminished stage of belief and confidence within the token’s efficiency.

The implications of this development increase questions concerning the present sentiment surrounding LUNC.

A contemporary evaluation of LUNC’s worth dynamics reveals that the token’s staking ratio now stands at 14.92%. This share signifies the portion of LUNC holdings which were dedicated to staking, underscoring the extent of engagement and dedication from the group.

Supply: Coingecko

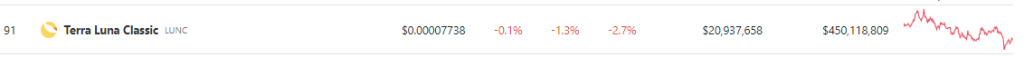

In the meantime, as noticed on CoinGecko, LUNC is presently valued at $0.000077. Over the previous 24 hours, the token’s worth has skilled a discount of 1.3%, whereas its worth has declined by 2.7% over the previous seven days.

These figures make clear the challenges LUNC at the moment faces throughout the market and the potential influence on investor sentiment.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes threat. While you make investments, your capital is topic to threat).

Featured picture from Analytics Perception