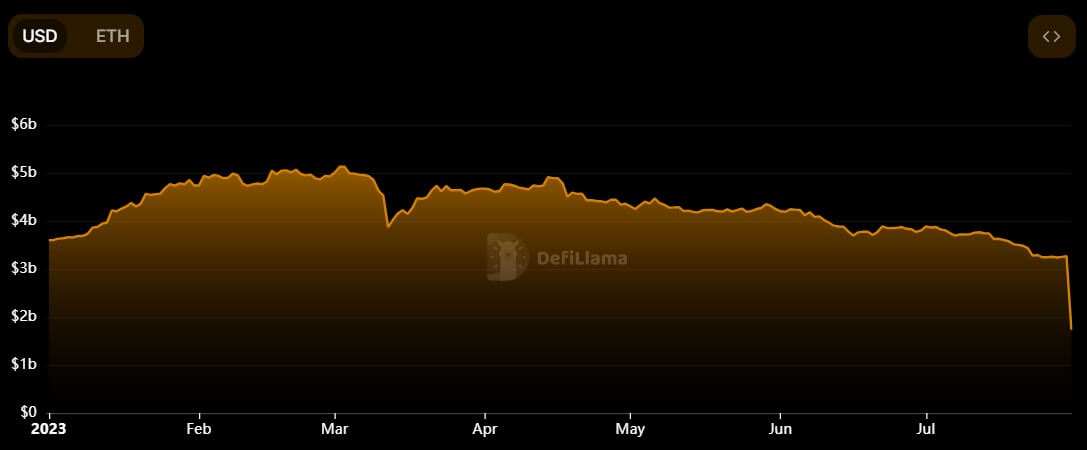

The entire worth of belongings locked on decentralized finance protocol Curve Finance (CRV) plunged almost 50% within the final 24 hours to $1.731 billion from $3.26 billion recorded on July 30, in keeping with DeFiLlama knowledge.

The exodus will be attributed to an exploit of the protocol, which elevated fears of liquidation and unhealthy debt amongst group members who instantly withdrew their belongings from the crypto challenge.

Vyper vulnerability impacts Curve Finance

On July 30, a malfunctioning ‘reentrancy locks vulnerability’ was discovered on a number of variations of Vyper, a wise contract language for the Ethereum (ETH) digital machine (EVM). The programming language confirmed the incident, revealing that crypto tasks working Vyper 0.2.15, 0.2.16, and 0.3.0 could possibly be impacted.

Following the information, Curve Finance said that a few of its steady swimming pools working Vyper 0.2.15 had exploited the malfunctioning reentrancy lock vulnerability.

A reentrancy assault permits an attacker to empty funds of a susceptible contract by repeatedly calling the withdraw perform earlier than it updates its stability. This assault has been generally used to exploit a number of DeFi protocols.

BlockSec, a blockchain safety agency, mentioned the reentrancy assault may probably danger all swimming pools with wrapped Ether (WETH).

Whereas it was unclear how a lot was stolen from Curve Finance’s stablecoin swimming pools, some estimates counsel that as a lot as $70 million may need been stolen.

Nonetheless, a MetaMask developer, Taylor Monahan, famous “a number of whitehat exercise + automated MEV bots,” that means the quantity may be lesser.

CRV’s worth tank

The exploit has made Curve’s CRV token extremely risky, with its worth dumping by round 15% to $0.64707 on the time of writing, in keeping with CryptoSlate’s knowledge.

In the meantime, CRV’s on-chain worth hit lows of $0.109 as liquidity tapered off after the CRV/ETH pool was attacked.

South Korean crypto trade Upbit suspended deposits and withdrawals for the token, citing vulnerabilities found on the DeFi challenge’s platform. The trade additional warned that CRV’s worth was “experiencing important volatility.”

Unhealthy debt and contagion fears

With hackers holding a major quantity of CRV, there are considerations that the token’s worth may fall additional if they begin promoting. This presents a contagion danger as a result of Curve founder Michael Egorov used the token as collateral on a number of lending protocols, together with Aave.

With Egorov having over $100 million in CRV as collateral on Aave, Inverse, and Abracadabra, a liquidation as a result of a drop in CRV worth will have an effect on Curve and all of the protocols.

To keep away from liquidation, Egorov has been paying down a number of the loans. Nonetheless, this may not forestall unhealthy debt and spillover results for different lending protocols uncovered to Curve.

In the meantime, Aave Ethereum v2 model has turned off the CRV borrowing perform. Wu Blockchain reported that this was most likely executed to forestall merchants from utilizing the Curve vulnerability to panic and the malicious shorting of borrowed CRV to advertise serial liquidation.