Questioning learn how to pay for a trip on a finances? Whether or not you’re dreaming of an unique seaside getaway or a weekend journey to the mountains, journey bills can add up quick. In a 2023 survey, 39% of Individuals mentioned they couldn’t journey as a result of costs had been too excessive.

Thankfully, there are methods to financially put together for future holidays and reduce the price of journey by strategically selecting your fee strategies, journey dates and extra.

5 methods to pay on your dream trip

Earlier than reserving your subsequent journey, strive these budget-friendly ideas for lowering your journey prices and avoiding expensive debt to pay for trip:

Bank card rewards

Bank cards will help pay for a trip. The best rewards bank card might cowl a few of your largest trip bills. Take into account these choices for making your journey extra inexpensive:

- Journey rewards bank cards: Earn journey factors or miles that may be redeemed for flights, accommodations, rideshare or experiences.

- Money-back rewards bank cards: Get a set proportion of money again for each greenback you spend, with increased percentages for sure classes like airfare.

- Welcome-bonus playing cards: Some playing cards supply a big, one-time bonus of rewards factors, miles or cash-back, while you hit a spending goal inside a set timeframe.

- Introductory 0% APR playing cards: Keep away from curiosity fees in your trip purchases by placing them on a 0% introductory APR card, after which paying them off earlier than the introductory interval ends.

Guide early

You’ll be able to keep away from paying excessive costs by reserving journey on the proper time. For those who wait till the final minute, your solely choices is likely to be ultra-pricey flights with extreme layovers and expensive accommodations in undesirable areas.

As a substitute, e book your stays through the preferrred occasions for value financial savings: about one to 4 months earlier than home flights and 10 to 11 months earlier than worldwide flights.

Guide throughout low season

Certain, everybody needs to move south for the winter, however touring with the pack comes at a premium. For cheaper flights and lodging, keep away from touring to your vacation spot throughout the next in style days and seasons:

- Main holidays and lengthy weekends

- Peak season for native climate

- Fridays and Mondays (for departing flights)

- Standard native occasions like festivals, parades or sporting occasions

It’s also possible to use a reserving software like Google Flights to view a forecast of fare costs on particular dates.

Sinking fund

A sinking fund is a financial savings fund you create to cowl a particular, future price. For those who’re planning a trip prematurely, you can begin constructing a sinking fund that can assist you pay for trip with money. Listed below are a couple of methods to make it occur:

- Set a financial savings goal on your journey, together with the complete price of flights, floor transportation, lodging, meals and actions.

- Divide your financial savings purpose by the variety of paychecks you’ll obtain earlier than your journey.

- Arrange an computerized, recurring deposit to your sinking fund from every paycheck, even when it’s solely a portion of the full quantity you could hit your financial savings goal.

- Preserve the funds in a high-yield financial savings account (HYSA) or one other account that earns curiosity, with no charges.

- Assessment your bank card and financial institution statements to search out prices you possibly can reduce between now and your trip, then divert the additional cash to your sinking fund.

- For household holidays, ask the children to make small contributions from their allowances or from cash earned for odd jobs.

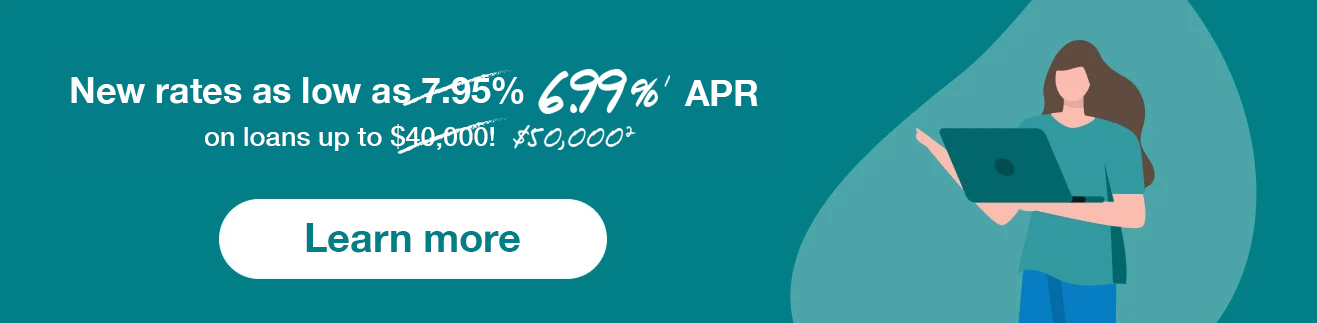

Trip mortgage

A trip mortgage is a private mortgage that’s used for the aim of journey. Whereas taking over debt isn’t preferrred, utilizing a mortgage as a substitute of a bank card might prevent cash because the rates of interest are sometimes a lot decrease on loans.

By comparability, the common APR on bank cards is almost 20%, however the common APR on a 24-month private mortgage is round 11%.

Begin saving now

An enormous trip isn’t a last-minute concept. You’ve in all probability been daydreaming about burying your toes within the sand or taking the children to EPCOT for months, if not a number of years.

For those who’re somebody who daydreams about large holidays, think about making them a actuality by working trip fee plans into your month-to-month finances. Even if you happen to simply save $50 a month, setting money apart for trip financial savings will provide help to notice the fantasy of getting away.

Written by Sarah Brady

Sarah Brady is a monetary author and speaker who’s written for Forbes Advisor, Investopedia, Experian and extra. She can be a former Housing Counselor (HUD) and Licensed Credit score Counselor (NFCC).

Learn extra

All private loans made by WebBank.

The Prosper® Card is an unsecured bank card issued by Coastal Neighborhood Financial institution, member FDIC, pursuant to license by Mastercard® Worldwide.