California-based Silicon Valley Financial institution (SVB), a unit of SVB Monetary Group, has been shut down, in accordance with an announcement from monetary regulators on March 10.

Silicon Valley Financial institution closed by regulators

The Federal Deposit Insurance coverage Company (FDIC) mentioned that the California Division of Monetary Safety and Innovation closed SVB immediately.

The FDIC mentioned that it has been designated because the receiver and added that eligible financial institution clients could have entry to insured deposits by March 13.

Although the FDIC didn’t describe the course of occasions main as much as SVB’s closure, the financial institution’s collapse was prompted by a March 8 sale proposal via which it aimed to cowl a $1.8 billion loss. The agency’s share worth fell by 60% from $267.83 to $106.4 inside a day.

This led to a financial institution run after third events suggested firms to withdraw funds on March 10. Buying and selling on the corporate’s shares has since been halted.

Executives, together with CEO Gregory Becker, CFO Daniel Beck, and CMO Michelle Draper collectively offered thousands and thousands of {dollars} of inventory within the weeks main as much as these occasions.

The corporate had $209 billion of property, which makes it the second-largest U.S. financial institution failure in historical past and the biggest financial institution failure because the 2008 monetary disaster.

Crypto firms might have publicity

Although Silicon Valley Financial institution just isn’t straight associated to the crypto trade, some crypto firms might have publicity to the failed financial institution.

Circle held funds with numerous banks, together with Silicon Valley Financial institution as lately as January. Nonetheless, the corporate has lately moved funds between banks, in accordance with TechCrunch, and it might or might not maintain funds with SVB at current.

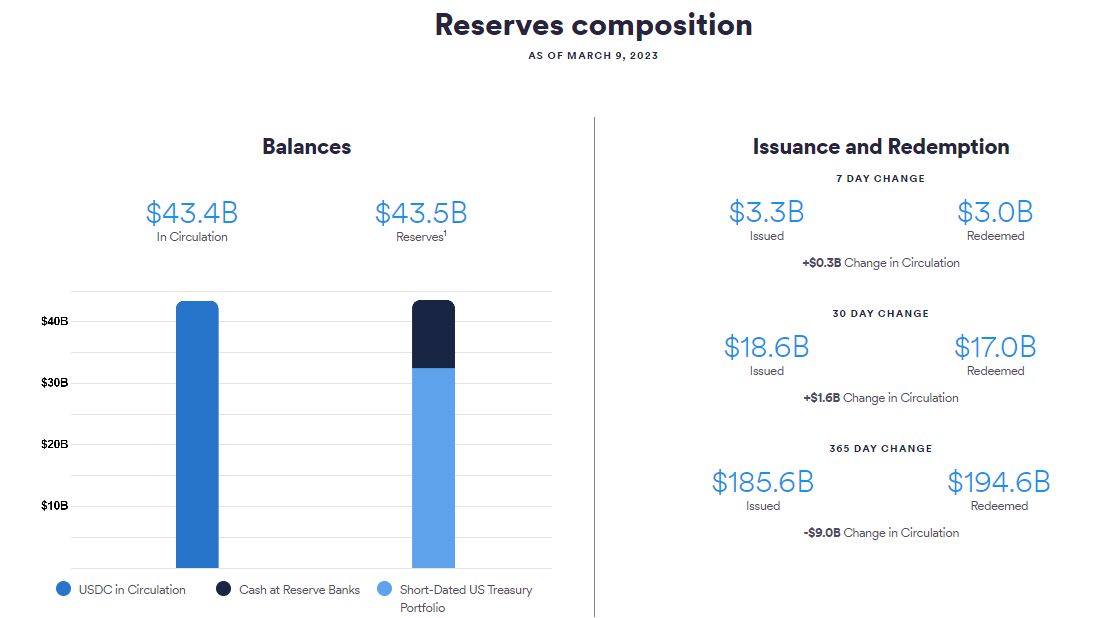

Although it’s unclear how a lot cash Circle may maintain with Silicon Valley Financial institution particularly, it at present holds 1 / 4 of its USDC reserves ($11 billion) in banks.

Elsewhere, bankrupt lending agency BlockFi was reported to have publicity to SVB. The U.S. Trustee mentioned in a March 10 submitting that BlockFi holds $227 million with the financial institution. It says these funds are “unprotected” and requires a bond or deposit beneath the chapter code.

Different firms deny publicity

Binance CEO Changpeng Zhao mentioned that his trade firm doesn’t have publicity to Silicon Valley Financial institution. He tweeted: “Funds are #SAFU.”

John Wu, president of Avalanche agency Ava Labs, has additionally commented on the scenario. In the course of the preliminary financial institution run on March 9, Wu mentioned that Silicon Valley Financial institution was one financial institution that his firm depends upon. Fairly than pulling all funds from the financial institution, he mentioned Ava Labs diversified and held much less with SVB than it did in earlier weeks and months.

Immutable Labs co-founder Robbie Ferguson mentioned that his firm has no publicity to Silicon Valley Financial institution, nor does it have publicity to the failing Silvergate Financial institution. Immutable is thought for its Immutable X blockchain and concentrate on Web3 gaming.

Elsewhere, the asset supervisor Valkyrie mentioned that it has no publicity or banking relationship with Silicon Valley Financial institution. It nonetheless referred to as the information “devastating.”

The Blockchain Intelligence Group (BIGG) and its associated Canadian crypto buying and selling platform Netcoins have additionally denied any publicity to the failed financial institution.