Huobi has arrange a $100 million liquidity fund following a 90% flash crash of the trade’s Huobi Token (HT) on March 9.

The trade’s international adviser Justin Solar confirmed this growth, including that the funds have been despatched to the trade.

HT is but to get better from its flash crash absolutely. In accordance with CryptoSlate’s information, the token is down 21% and is buying and selling for $3.80 as of press time.

Why Huobi is organising the 100M liquidity fund

In accordance with Solar, HT’s sudden collapse was brought on by “just a few customers, ” triggering a cascade of pressured liquidations within the spot and HT contract markets. Nonetheless, he added that these fluctuations have been merely a results of market conduct.

Kaiko information researcher Riyad Carey stated the HT token had round $2 million price of promote orders towards $600,000 purchase orders 5 minutes earlier than the crash. As well as, the broader crypto market witnessed a large sell-off throughout the identical interval, liquidating over $300 million in lengthy positions.

Solar stated Huobi would enhance its multi-currency liquidity by organising the $100 million liquidity fund to forestall a future recurrence. He added:

“We are going to proceed to enhance the liquidity depth of primary cryptocurrencies and HT token, strengthen leverage danger warnings and liquidity capabilities.”

In the meantime, the Tron founder promised Huobi would “bear all leverage-through place losses on the platform [that] resulted from this market volatility occasion of HT.”

Huobi sees outflows

Within the final 24 hours, Huobi’s reserve dropped by $72.4 million, in keeping with CryptoQuant’s information.

CryptoQuant information confirmed that the trade noticed a $33.1 million outflow in Bitcoin (BTC), $10.3 million in Ethereum (ETH), a cumulative stream of $13.9 million in different altcoins, and $14.8 million in stablecoins.

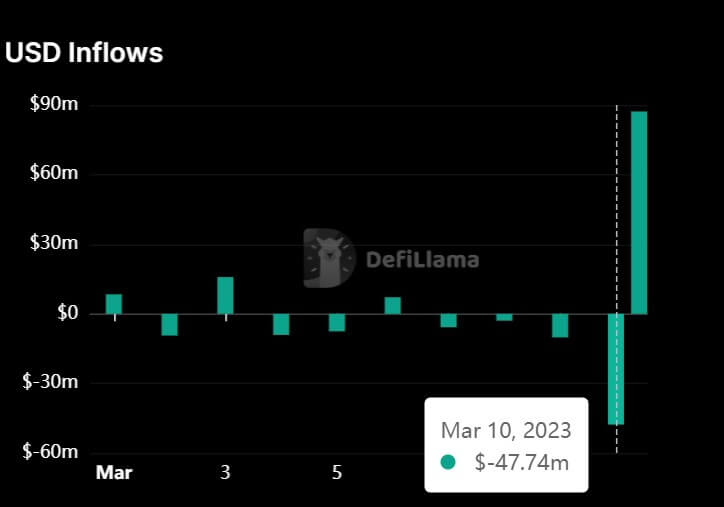

DeFiLlama information corroborated that Huobi has seen outflows in the course of the reporting interval. The information aggregator stated the trade’s outflow was $47.74 million.

In the meantime, the trade noticed an influx of $87.22 million that the $100 million liquidity fund closely influenced.

Nansen information confirmed that Huobi reserves maintain $2.8 billion in digital property. The trade’s native token accounts for 26.61% of its reserves, whereas Tron’s TRX makes up roughly 20%.