A number one analytics agency says that deep-pocketed buyers are scooping up tens of millions of Chainlink (LINK) after a sudden worth dip to a three-year low.

Santiment says that wallets holding between 1,000 to 100,000 Chainlink gathered 3.9 million LINK, price about $20 million, over the past week.

The large whale exercise marked a file excessive for 2023, based on the agency.

“The quantity of Chainlink whale transactions has hit a 2023 excessive as costs fell to a three-year low $5 this weekend. Mid-sized 1,000-100,000 LINK wallets are notably accumulating large, with 3.9 million LINK (price $20 million) gathered up to now week.”

At time of writing, the decentralized oracle community is buying and selling for $5.21, down 16.3% in the course of the previous seven days, and is down over 90% from its all-time excessive.

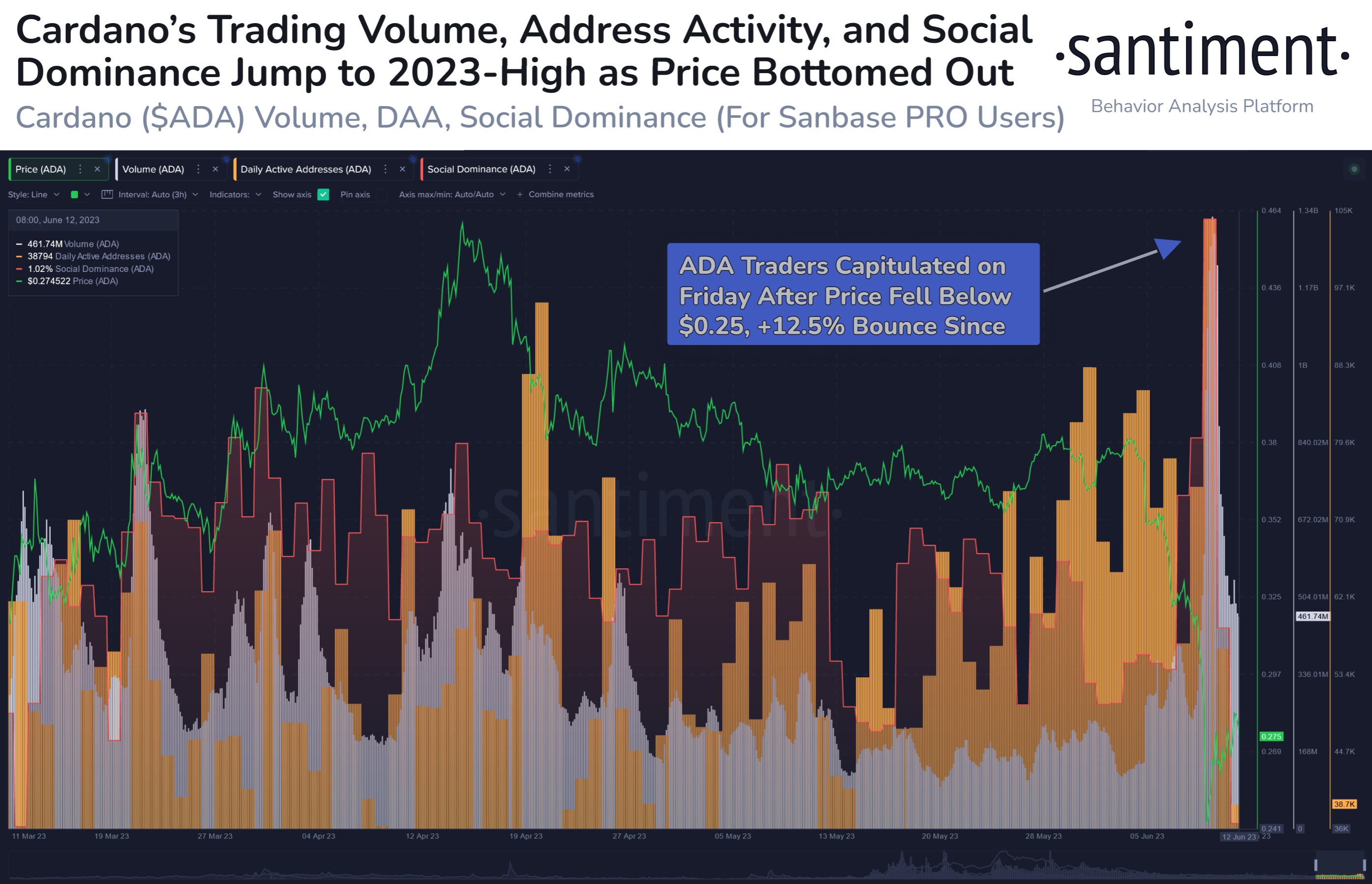

Santiment has its radar on Ethereum (ETH) competitor Cardano (ADA), which the agency says might have reached its “purchase the dip” zone after a crash on the weekend.

The analytics agency says that buying and selling quantity and social dominance is at 2023 highs for ADA after it dipped to the $0.25 degree.

“The Cardano capitulation occurred extra notably than different altcoins throughout Friday’s crash. After costs fell -35% between June 5-9, the buy-the-dip alternative got here when ADA quantity, tackle exercise, and social dominance all hit 2023 highs on Saturday.”

Cardano is price $0.27 at time of writing, down 22.4% over the past seven days, and is 91% down from its all-time excessive.

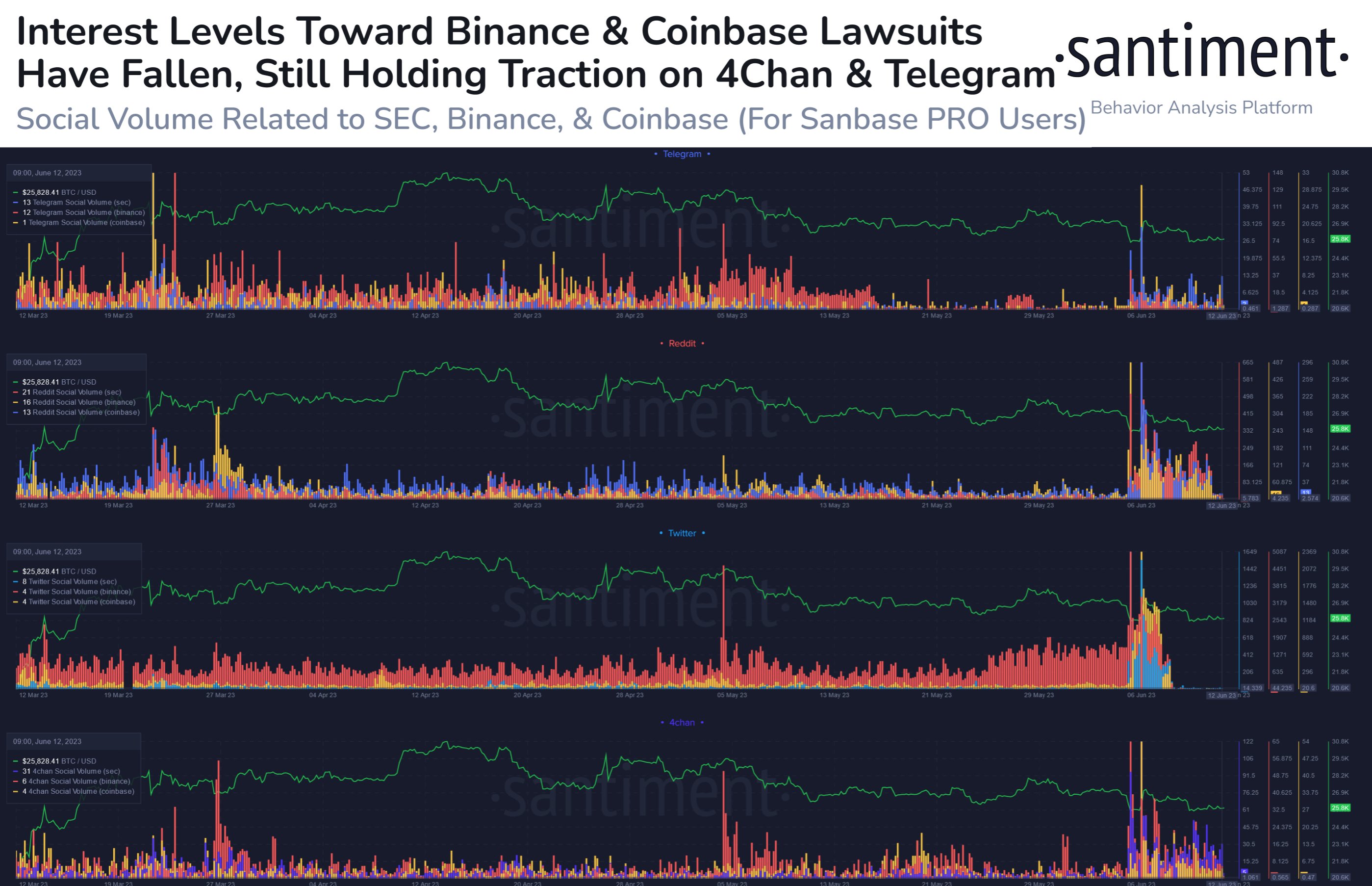

In keeping with Santiment, the altcoin market seems to be within the strategy of stabilizing this week after plummeting over the weekend. The collapse was coincided with the U.S. Securities and Alternate Fee (SEC) suing the world’s high two crypto exchanges, Binance and Coinbase for alleged securities violations and labeling plenty of altcoins as securities.

“With merchants nonetheless very a lot conscious of the SEC going after Binance and Coinbase, the mass hysteria has at the very least settled down. Till the subsequent developments with the lawsuits, we might see some gradual rising of costs again to pre-crash ranges.”

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/David Sandron/Vit-Mar