Key gamers within the crypto ecosystem are shoring up their defenses amid rising issues over the state of Multichain, a significant venue for transferring property between completely different blockchains.

4 days after obvious technical points began throttling some customers’ potential to withdraw tokens from the protocol, wild rumors over Multichain’s security and the destiny of its crew are filling the void created by the platform’s silence. A single tweet blaming some cross-chain breaks on “power majeure” has solely added gasoline to the widespread hypothesis that one thing is amiss.

The sunshine-on-facts panorama is pushing a rising variety of entities to mitigate threat now – no matter Multichain’s true state. Their responses are highlighting how crypto bridges create the potential for a world of harm that goes effectively past the flashiest and well-trodden threat to bridges (getting hacked by North Korea).

The scenario is compounded by Multichain’s prominence amongst bridges. It’s the third-largest bridging protocol by switch quantity and whole worth locked, in keeping with information from Messari and DeFiLlama.

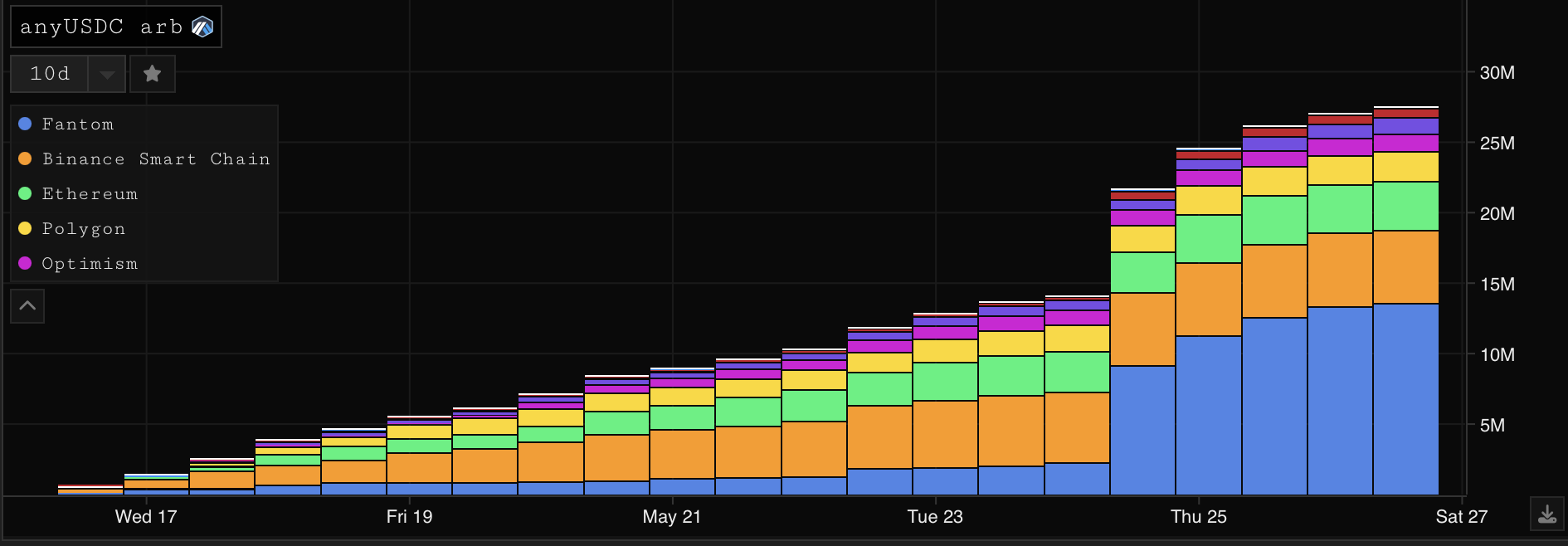

Like most bridges, Multichain makes use of a mint-and-lock mechanism to maneuver property between the 92 blockchains it interacts with. For instance, if a holder of USDC stablecoin bridges the asset from Ethereum to Fantom by way of Multichain, the token will get locked up in a wise contract on Ethereum after which issued anew on Fantom – on this case, as a “wrapped” token known as anyUSDC.

Multichain’s anyUSDC and different wrapped USDC tokens prefer it dominate 50% of Fantom’s stablecoin market, in keeping with DeFiLlama. That is regardless of all USDC on Fantom being “bridged” property as an alternative of “native” that Circle points immediately onto the chain. Thus, all of the USDC tokens on Fantom are reliant on bridges to retain their worth.

This setup works so long as the bridge does. On the top of Multichain’s troubles this week, it didn’t, and wrapped USDC tokens on Fantom misplaced their greenback peg. Some arbitrage merchants informed CoinDesk they purchased wrapped USDC tokens at a 30% low cost through the fracas over Multichain, which is liable for 80% of the stablecoins on Fantom.

Binance, the world’s largest crypto change, seemingly pointed to the dangers of non-native property Friday with a tweet imploring merchants to “bear in mind to verify you belief the issuer behind stablecoins you maintain.”

The Fantom ecosystem’s excessive reliance on Multichain hasn’t spooked market contributors right into a mass exodus fairly but. General numbers like whole worth locked stay relatively regular regardless of some outflows to different chains, in keeping with information from terminal-builder Parsec.

“The multichain bridge is absolutely operational and secure with Fantom. No matter is occurring internally with multichain has no influence on the bridged property on Fantom,” Michael Kong, CEO of the Fantom Basis, informed CoinDesk.

Squid Router – a bridging protocol constructed on Axelar that not like Multichain makes use of swaps as an alternative of wrapped tokens to maneuver worth throughout chains – additionally reported a surge in exercise through the Multichain madless. Bridge transactions on Axelar itself elevated sixfold through the spike, folks acquainted with the matter stated.

However Multichain’s methodology of wrapping property to bridge them has spooked gamers past the stablecoin markets. On Thursday, Binance stated it will quickly droop deposits in 10 Multichain-bridged tokens “whereas we await readability from the Multichain crew.”

Bridging aggregation service Li.Fi additionally took preventative measures yesterday and shuttered entry to Multichain.

Amid all this Multichain’s namesake asset MULTI has suffered. It was buying and selling at $3.8 at press time, a 54% drop from the place it was earlier than the disaster of confidence started.

Edited by Stephen Alpher.

https://www.coindesk.com/enterprise/2023/05/26/binance-other-crypto-players-shun-multichain-as-bridging-rumors-swirl/?utm_medium=referral&utm_source=rss&utm_campaign=headlines