Final month, the NFT market noticed a spike in buying and selling quantity on April fifth, adopted by a big 50% drop by the tip of the month. The variety of NFT sellers exceeds the variety of consumers, indicating a possible oversupply available in the market.

As these markets evolve and develop, traders and merchants should keep abreast of the most recent developments and traits. By analyzing the important thing elements driving the cryptocurrency and NFT markets, we are able to higher perceive the alternatives and dangers related to these rising traits.

Information from this report was obtained from Footprint’s NFT analysis web page. A simple-to-use dashboard containing essentially the most very important stats and metrics to know the NFT trade, up to date in real-time, yow will discover all the most recent about trades, tasks, fundings, and extra by clicking right here.

Key Findings

Crypto Macro Overview

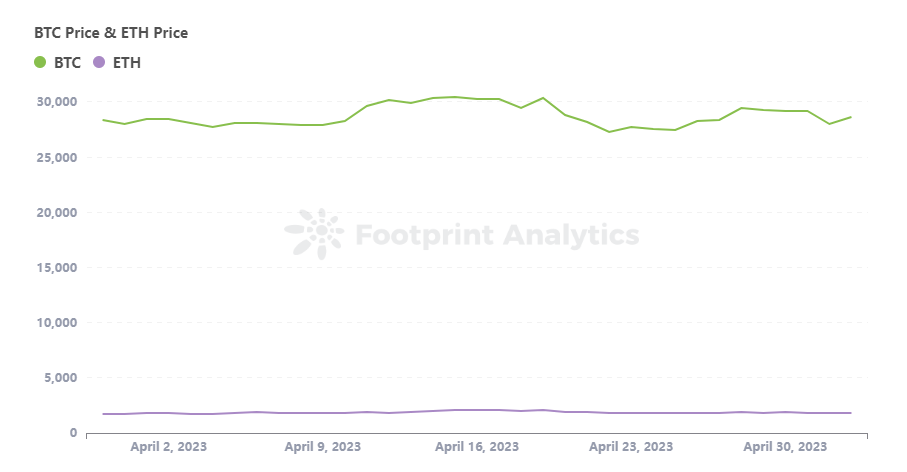

- The cryptocurrency market skilled ups and downs in April, with Bitcoin rising to $30,506 and Ethereum breaking by means of $2,100 on optimistic financial knowledge.

- Regardless of some volatility, the cryptocurrency market stabilized in the direction of the tip of April, with Bitcoin pushing again in the direction of $30,000 and optimistic sentiment prevailing.

NFT Market Overview

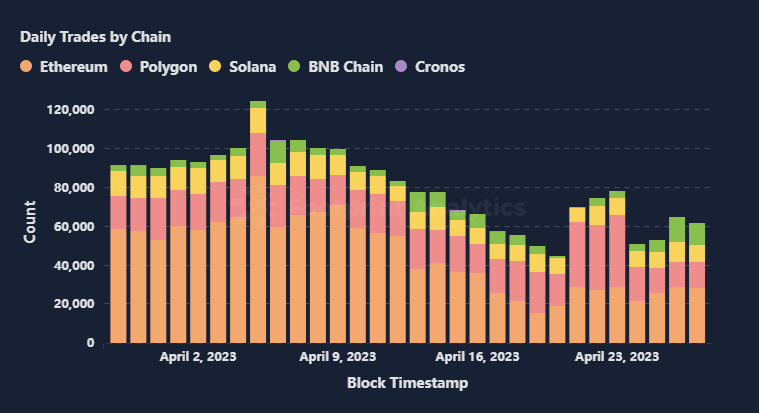

- The NFT market noticed a spike in buying and selling quantity on April fifth however skilled a big 50% drop by the tip of the month.

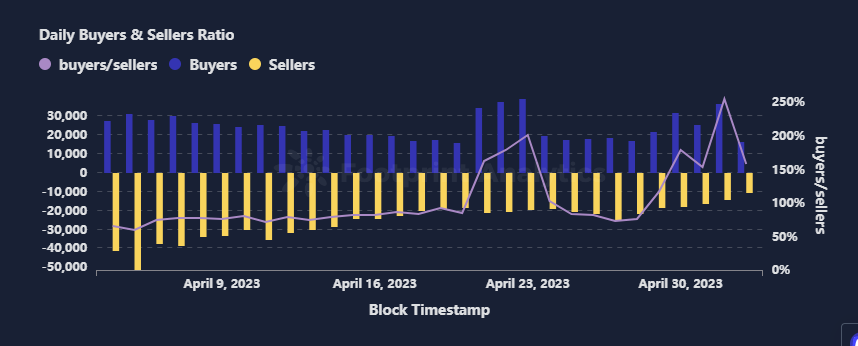

- The variety of NFT sellers exceeds the variety of consumers, indicating a possible oversupply available in the market.

Chains & Marketplaces for NFTs

- Ethereum dominates the NFT market quantity, however community congestion and charges might drive customers to options corresponding to Polygon.

- Blur and OpenSea cater to high-end and retail merchants, however each encroach on one another’s territory and will combine.

NFT Funding & Funding

- Regardless of a slight enhance within the variety of NFT tasks, the lower in funding signifies traders’ warning about investing.

- Platform constructing and scalability options are important for NFTs, as demonstrated by Move’s $3 million seed funding of its NFT market.

Scorching Matters of the Month

- Integrating AI and NFT expertise emphasizes the significance of NFT provenance for copyright safety and the worth of human creativity in inventive expression to strike a steadiness for sustainable improvement.

Crypto Macro Overview

In April, the cryptocurrency market skilled some ups and downs. On April 14th, most cryptocurrencies traded increased because of better-than-expected U.S. financial knowledge, with Bitcoin rising to $30,506, whereas ETH broke by means of $2,100 on April sixteenth.

On the macro entrance, official inflation rose to five% in March, barely under the consensus of 5.1%. Nonetheless, investor focus has shifted to potential recessionary dangers after the banking disaster uncovered the fragility of the market’s monetary system. Current knowledge additionally factors to a macroeconomic slowdown, because the ISM Buying Managers’ Index fell to its lowest since Might 2020.

Regardless of the volatility, bitcoin pushed again to 30,000 in late April, with optimistic sentiment throughout the crypto market.

NFT Market Overview

The NFT market attracted a lot consideration originally of 2021 as quite a few tasks launched their very own NFT collections. Nonetheless, the NFT market has proven indicators of weak spot this yr.

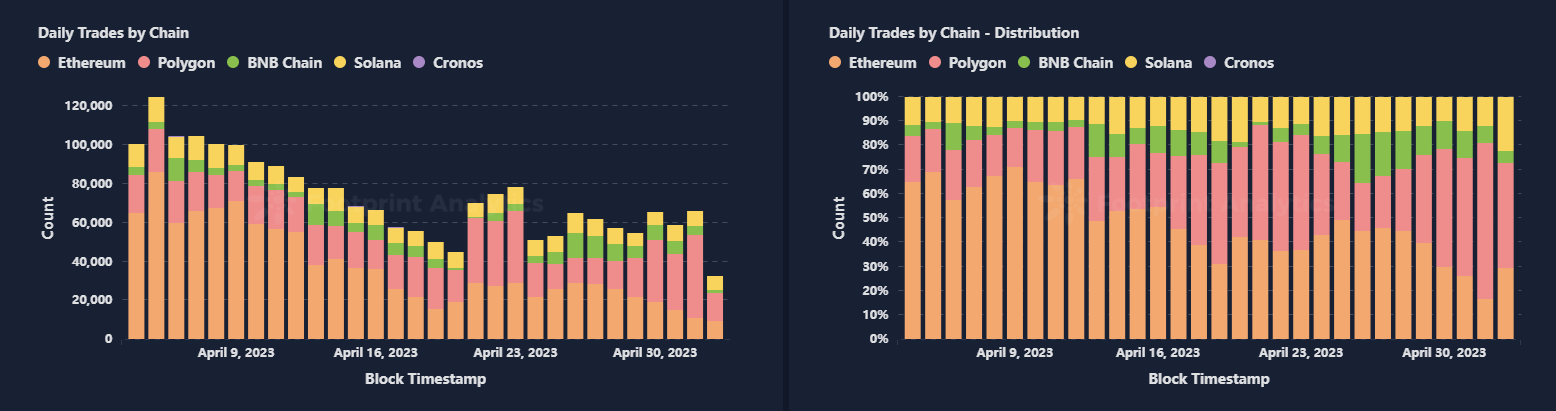

Based on Footprint Analytics, the NFT market peaked in buying and selling numbers on April 5, however every day trades had dropped by 50% by the tip of the month. This decline in buying and selling exercise suggests a rising sense of warning amongst traders because the preliminary enthusiasm for the NFT market seems to be fading.

As well as, in line with Footprint Analytics, the variety of NFT sellers available in the market continues to exceed the variety of consumers, suggesting that there could also be inadequate underlying demand.

The preliminary hype across the NFT market was pushed by the cryptocurrency market and movie star endorsements, resulting in a rush of individuals getting into the market. Nonetheless, the quantity of people that perceive NFTs is comparatively small, resulting in oversupply. It stays to be seen whether or not the basics of NFTs can ultimately help market development and open up new alternatives.

Chains & Marketplaces for NFTs

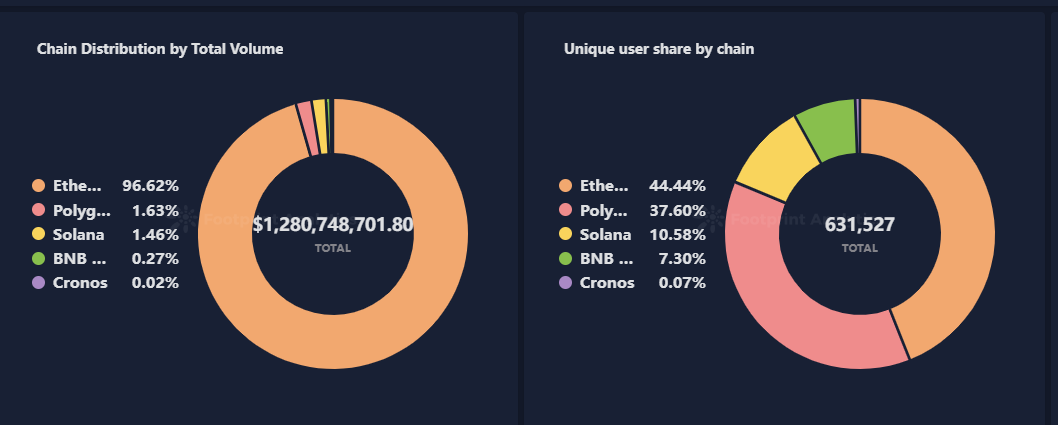

Based on Footprint Analytics, Ethereum holds the lion’s share of NFT transaction quantity, with a large 96% market share. Nonetheless, in terms of energetic customers, Ethereum solely accounts for 44%, whereas Polygon’s energetic consumer base is shut behind at 37%.

Whereas Ethereum stays the platform of selection for many mainstream NFT tasks, its community congestion and excessive transaction charges might drive some customers to different platforms. Consequently, Ethereum might face challenges in sustaining its dominant place within the NFT market.

Polygon’s every day trades are catching up with Ethereum, with transaction quantity not excessive. Nonetheless, the variety of trades is comparable, indicating that it’s extra appropriate for small merchants because of decrease boundaries to entry. Polygon’s low boundaries to entry make it extra appropriate for small transactions and asset exchanges, that means that its market could also be extra decentralized and multi-domain. Nonetheless, gathering high-value and high-quality NFT tasks and property can also be harder. Subsequently, it takes longer to construct an excellent ecosystem and accumulate property.

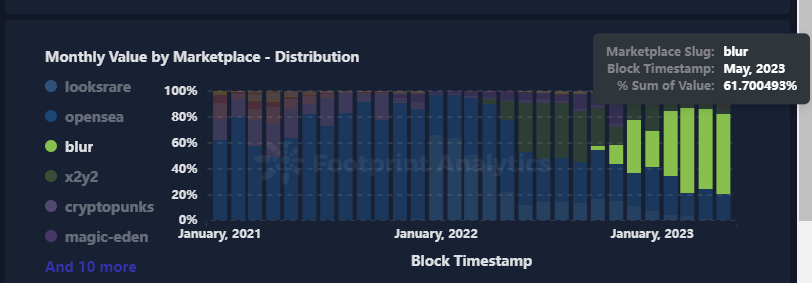

From a market perspective, Blur nonetheless has an absolute benefit relating to transaction quantity. Nonetheless, by way of the variety of transactions, OpenSea nonetheless has the higher hand. Blur’s dominant place suggests it’s extra appropriate for high-value property {and professional} customers with bigger transaction sizes. Then again, OpenSea’s transactions are looser and extra dispersed, with smaller transaction sizes, making it extra appropriate for retail customers and small every day transactions.

Blur and OpenSea characterize high-end and small merchants, respectively. Nonetheless, with the market’s general improvement, each are encroaching on one another’s territory, and the competitors is changing into extra intense. The long run development could also be additional integrating high-end and small markets, making a sure synergy impact. Continued monitoring of the efficiency of each platforms might be essential to predict their future improvement.

NFT Funding & Funding

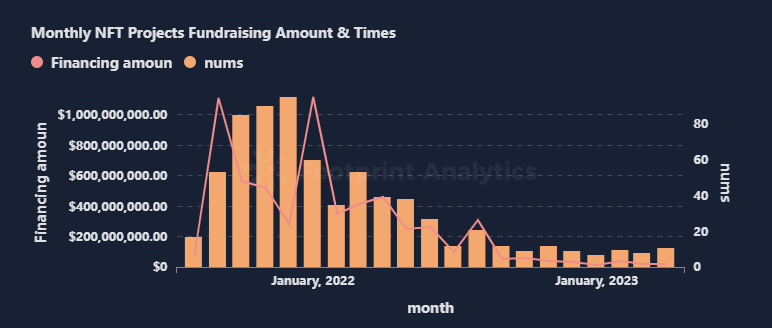

Whereas the variety of NFT funding tasks barely elevated from 8 to 11 in comparison with final month, the quantity of funding has decreased, indicating a extra cautious method by traders.

Many builders are engaged on the NFT market. Move, which secured $3 million in seed funding to construct a rollup-centric NFT ecosystem, highlights the rising want for layer 2 and scalability options to deal with Ethereum community points. Additionally, the entry of enormous firms corresponding to Amazon into the NFT market is anticipated to extend market visibility and measurement but in addition enhance trade dangers.

As well as, the music and leisure industries are exploring NFT, as evidenced by Muverse and Daniel Allan Leisure, which obtained funding this month, opening up new alternatives for NFT functions.

Scorching Matters of the Month

As Chatgpt turned well-known, folks began speaking about integrating AI and NFT, as NFT is a good instance of a artistic economic system within the crypto world.

KOL 6529 offered a consultant dialogue on this subject. On the one hand, as the quantity of AI-generated content material will increase, the significance of NFT provenance expertise is additional highlighted. NFT provenance may also help distinguish the supply and possession of content material and shield the copyright of content material creators.

Conversely, the proliferation of AI-generated content material makes unique human content material extra invaluable. The distinctiveness of human creation is tough to fully substitute by AI, making unique works extra scarce and invaluable. Subsequently, the flexibility of creators to construct their reputations is particularly essential in an period of digital content material overload. Solely by permitting extra folks to know and acknowledge their work can creators stand out within the fierce competitors for content material.

Business content material creation is extra simply changed by AI, whereas inventive creation is tough to interchange. Business content material is often accomplished round a sure demand and might be effectively generated by AI expertise, making it extra simply changed by machines. In distinction, the worth of paintings lies within the writer’s ideas and emotional expression, which is tough for AI to realize and requires the distinctive perspective and creativity of human artists.

Though AI creation is rising, human creativity stays irreplaceable within the type of inventive expression. Hanging a steadiness between copyright safety, artistic instruments, and human expression is vital to the sustainable improvement of NFT and encryption applied sciences.

Closing Ideas

The world of NFTs is quickly evolving, with new traits and developments rising month-to-month. April was no exception, as the marketplace for these digital property skilled important fluctuations and new developments. Whereas the spike in buying and selling quantity originally of the month adopted a drop in the direction of the tip, the NFT market stays a dynamic and promising sector.

Because the NFT market grows and matures, staying abreast of the most recent traits and developments is essential. By understanding the alternatives and dangers related to this rising expertise, traders and merchants could make knowledgeable choices and capitalize on the potential of NFTs.

This piece is contributed by Footprint Analytics group,

We’re thrilled to ask establishments and tasks to construct out your customized analysis pages like this. With our assist, you possibly can simply personal your knowledge web site for analysis with none coding expertise or technical enter. Merely fill in this manner to use for the waitlist and get began as we speak.

The Footprint Neighborhood is the place knowledge and crypto lovers worldwide assist one another perceive and acquire insights about Web3, the metaverse, DeFi, GameFi, or another space of the fledgling blockchain world. Right here you’ll discover energetic, various voices supporting one another and driving the group ahead.