Whereas most banks have some sort of economic training technique, few prospects notice it. That makes these efforts futile, outcomes of a examine by Greenlight reveal.

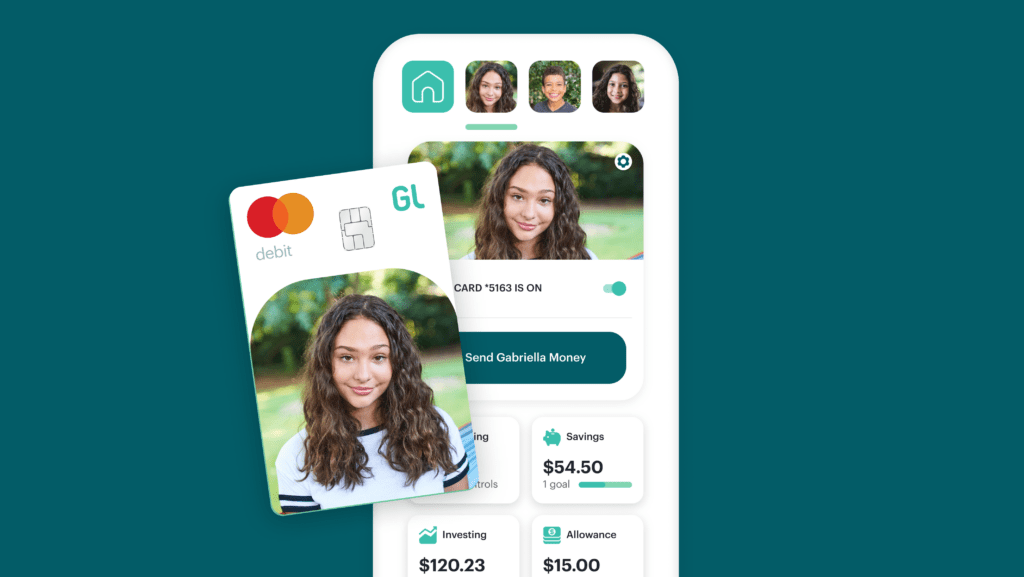

VP of enterprise growth Matt Wolf described Greenlight as a household finance firm. It affords a banking app and debit card. Each assist train youngsters and, in lots of circumstances, their dad or mum’s sensible monetary habits. Roughly six million individuals are registered with Greenlight. Collectively they’ve saved over $300 million and invested $20 million.

JP Morgan Chase’s Chase First Banking makes use of Greenlight expertise, Wolf mentioned. A couple of million households use the service.

How Greenlight pivoted to fulfill the monetary literacy want

With few American faculty methods instructing monetary literacy, mother and father price it as their primary concern, Wolf mentioned. It was for Greenlight’s founders, who collectively have seven kids. They began the corporate as a result of they needed a dependable resolution they might use to present cash to their kids whereas being able to set spending limits.

Early prospects advised Greenlight additionally they used the app to show youngsters clever monetary conduct, so the corporate invested in monetary literacy. They employed training specialists to create mobile-friendly movies and quizzes which might be gamified to permit prospects to earn digital (and shortly, bodily) items.

“We discovered by way of our analysis that it makes the youngsters need to hold coming again and take extra classes,” Wolf mentioned. “It’s known as Stage Up as a result of we would like them to get to larger ranges of their monetary data.

“Some mother and father come to us and say they discovered so much by enjoying this sport with their youngster. We count on this might be one thing youngsters and fogeys might do collectively.”

Most banks have monetary literacy methods, however you wouldn’t realize it

Persons are embracing the app as a result of there’s a perceived lack of economic literacy choices available on the market. Most individuals surveyed, 93%, consider banks ought to be serving to households with monetary training, however solely 15% say banks are doing it. With most banks having some kind of monetary literacy technique, that’s a transparent message to these many efforts that fail to succeed in their audience.

Additionally, learn:

Why are so many efforts so ineffective? There are a number of causes, Wolf mentioned. One of many largest is that they don’t meet youthful generations the place they’re – within the cell realm. Inside the subsequent few years, 42.9 million members of Technology Z will likely be cell banking. A digital-first program is essential.

Most banks wouldn’t have the time, cash, or certified workers to develop an efficient program in-house. That’s the place Greenlight is available in, Wolf mentioned. Greenlight for Banks permits banks to supply Greenlight’s household banking and academic merchandise free of charge to their prospects. Dad and mom can automate allowance, reward youngsters for finishing chores, and immediately ship cash to their youngsters. They will additionally restrict youngsters’ spending in particular classes and places. (The app will be downloaded immediately from Greenlight’s web site for a small charge.)

“So long as it was on the Google Maps API, you possibly can restrict it to that granularity,” Wolf mentioned whereas including location sharing, SOS alerts, and crash detection with automated 911 dispatch are additionally obtainable.

Banks rapidly notice partnership advantages

Shoppers can co-brand the method by way of a co-branded touchdown web page, registration, and app expertise. They are often up and working in three weeks, Wolf mentioned. Youngsters may even design their bodily debit playing cards. Within the works are new video games and rewards, together with the flexibility to offer bodily rewards like account deposits for finishing duties. Coming this summer season is an SDK that gives the entire Greenlight expertise inside an establishment’s app.

With many banks dropping deposits, Greenlight permits them to draw some. Banks can maintain deposits of their establishment as a substitute of with Greenlight’s associate banks.

“The one constant factor is that the funding supply for Greenlight must be the associate financial institution,” Wolf defined. “When a dad or mum registers for Greenlight, they should use that associate financial institution or credit score union’s DDA account or debit card to fund the Greenlight dad or mum pockets for it to be free.” (Folks may get Greenlight’s apps immediately from the corporate.)