14 Apr What’s Lido (LDO)?

Lido is a Decentralised Autonomous Group (DAO) and Liquid Staking protocol which arose within the days previous to Ethereum’s well-known “Merge” when staking first went into play inside the Ethereum ecosystem.

Lido solved the issue of Ethereum’s 32 Ether staking requirement, and likewise lets customers entry the locked worth of their staked tokens via its Liquid Staking innovation. Liquid Staking lets Lido customers preserve the liquidity of their staked tokens through the use of a stand-in stToken which can be utilized to earn further yield via Decentralised Finance (DeFi) market participation.

Lido’s group governs the path of the Lido challenge through decentralised governance utilizing the Lido DAO’s LDO token. Lido is Ethereum-first however has added assist for a number of different Proof of Stake (PoS) blockchains. Lido’s mission is to make staking easy and decentralised, whereas making staking accessible to as many individuals as potential.

Lido

Lido was created to permit any consumer to trustlessly stake their ETH simply, irrespective of how a lot they’ve, in any quantity. Lido doesn’t solely make it simple to stake ETH and earn rewards, it additionally solves the issue of accessing the locked worth when tokens are staked via a mechanism known as Liquid Staking.

Lido makes it easy and handy to stake and earn curiosity regardless of any technological hurdles. By staking with Lido your belongings stay liquid and can be utilized throughout a variety of DeFi functions, incomes additional yield. Lido helps Ethereum and a number of other prime blockchains.

How Does Lido Work?

By staking through Lido, an ETH holder beneficial properties stETH, an stToken which is a placeholder token for the locked ETH. stETH can be utilized prefer it was common ETH at many alternative DeFi platforms which have built-in assist. Lido’s stTokens have assist inside a number of the hottest DeFi apps, like Metamask, AAVE, Uniswap, and others.

stTokens let customers improve their yield upon their staked tokens by releasing the locked worth of the tokens presently held inside the staking pool. Upon staking, a consumer receives stTokens in return for his or her locked belongings.

stTokens enable a Lido consumer to carry the stToken nearly like a digital poker chip that represents the worth of the underlying staked asset. The stToken can be utilized for DeFi yield incomes, decentralised lending, offering liquidity, buying and selling on decentralised exchanges (DEX), and extra.

Lido began out centered solely on Ethereum, however has since added assist for a number of further blockchains like Polygon, Solana, Polkadot, and Kusama. Its stTokens signify every supported digital asset. So along with stETH, there may be stDOT, stSOL, and so forth. Along with stTokens, Lido’s DAO additionally utilises LDO. LDO is Lido’s governance token for decentralised determination making inside the DAO.

What Makes Lido Distinctive?

- Lido makes staking easy. Anybody can stake their digital belongings to earn the rewards via Lido with out minimal deposits and {hardware} setup and upkeep.

- Staked belongings stay liquid and accessible. Not like native staking, Lido lets customers stake their belongings with out locking tokens as customers obtain stTokens in return, which will be swapped, traded, and transferred at any time. Moreover, Lido’s stTokens have been built-in by a variety of DeFi protocols on each Layer 1 and Layer 2 blockchains inside the multi-chain ecosystem.

- Lido helps quick exit for unstaking. Unstaking in PoS protocols usually requires a ready interval which might be unsure and see lengthy delays which might be important in occasions of market turmoil. Lido stakers are allowed to swap their stTokens to another belongings through secondary markets to fulfil a quick exit

What’s the Lido Ecosystem?

The Lido ecosystem is fairly properly developed, as Lido has efficiently made many essential partnerships with a number of the largest names within the wider multi-chain Web3 ecosystem. Lido’s managed to efficiently combine stToken and LDO assist into many wallets, layer 1 blockchains, Ethereum Layer 2 chains and protocols, DeFi protocols and platforms, Oracles, and Knowledge Analytics instruments.

There is just too a lot to cowl on this article, for extra details about the Lido ecosystem, click on right here.

What’s Lido’s LDO token?

LDO is the governance token of Lido’s DAO, the decentralised physique which carries out the governance choices of the Lido group.

LDO is an ERC-20 token which supplies holders governance rights and the flexibility to vote on enchancment proposals, upgrades, and community parameters. The extra LDO locked in a consumer’s voting contract, the higher the decision-making energy the voter will get.

Lido’s DAO additionally manages the Lido DAO’s insurance coverage and improvement funds, and the deliberate unbonding and withdrawals coming with Ethereum’s Shappella improve.

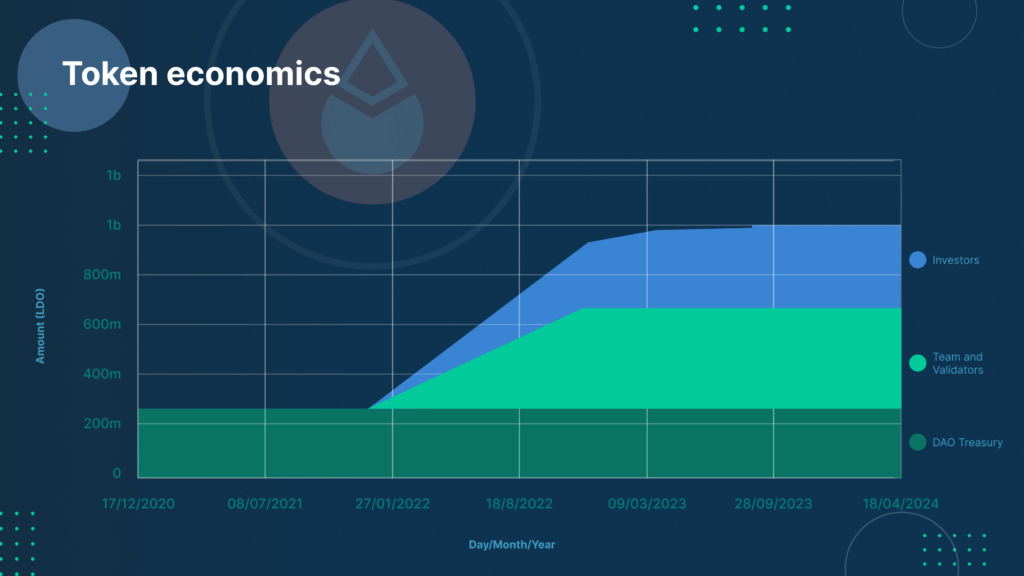

Lido (LDO) Tokenomics

Lido Roadmap

The Lido improvement group and group are presently centered on Lido V2, Lido’s most formidable community improve to this point. Lido V2 will add compatibility with Ethereum’s Shapella improve which permits for withdrawals of staked ETH for the primary time, in addition to add “Staking Router” assist.

- Withdrawals: This Lido on Ethereum protocol improve permits stETH holders to withdraw from Lido at a 1:1 ratio to unstake immediately with Lido. This will likely be stay in roughly Might.

- Staking Router: Due to a brand new modular architectural design, anybody can develop on-ramps for brand new Node Operators, starting from solo stakers, to DAOs and Distributed Validator Know-how (DVT) clusters. Collectively they’ll create a extra various validator ecosystem.

The Lido Group

Lido is a contributor-driven DAO with no centralised group. Preliminary contributors will be discovered right here.

Notable Lido Companions

- Lido on Ethereum Node Operators: Certus.One, P2P Validator, Refrain, Stakefish, Staking Amenities, Blockscape, DSRV, Everstake, Kiln, RockX, Figment, Allnodes, Anyblock, Blockdaemon, Stakin, ChainLayer, Merely VC, BridgeTower, Stakely.io, InfStones, HashQuark, Codefi, SigmaPrime, Pragmatic Labs, ChainSafe, Nethermind, Kukis International, CryptoManufaktur, RockLogic, Attestant.

- Lido on Polygon Node Operators: ShardLabs, DSRV, HashQuark, Kytzu, Girnaar Nodes, Matrix Stake.

- Lido on Solana Node Operators: Blockdaemon, Block Logic, Forbole, ChainLayer, RockX, Figment, Refrain, Stakefish, P2P Validator, DSRV, Everstake, Staking Fund, Chainode Tech, SyncNode, Stakewith.us, Stakin, Allnodes, Kiln, 01Node, H2O Nodes, Kukis International.

Learn how to purchase LDO on Bitfinex

Learn how to purchase LDO with crypto

1. Log in to your Bitfinex account or join to create one.

2. Go to the Deposit web page.

3. Within the Cryptocurrencies part, select the crypto you intend to purchase LDO with and generate a deposit tackle on the Alternate pockets.

4. Ship the crypto to the generated deposit tackle.

5. As soon as the funds arrive in your pockets, you’ll be able to commerce them for LDO. Learn to commerce on Bitfinex right here.

Additionally, we have now Bitfinex on cell, so you’ll be able to simply purchase LDO foreign money whereas on-the-go.

[AppStore] [Google Play]

Lido Group Channels

Web site | Twitter | Telegram | Reddit | Discord