We’re excited to share Bondora Group’s 2023 monetary outcomes, with the best spotlight being our seventh consecutive 12 months of profitability. Final 12 months was a affluent chapter in our monetary journey, showcasing what’s attainable whenever you put your prospects first. We’ve not solely sustained development but additionally delivered dependable returns to our buyers. Thanks for being part of our journey, and let’s dive into the main points!

Key highlights from our 2023 monetary outcomes

- Income reached €44,4 million

- Web revenue was €3,4 million

- Loans issued totaled €202,5 million

- €139 million of loans had been issued in Finland and €40,2 million in Estonia

Bondora Group’s 2023 in evaluate

At Bondora Group, our mission is easy: to assist folks stay the life they need with much less monetary stress. We provide user-friendly, safe options that make lending and investing accessible and easy. Our companies are totally on-line, making it as handy as attainable for our prospects to attain their monetary objectives.

2023 additionally marked the sixth 12 months in a row that our Go & Develop buyers have loved a steady return of as much as 6.75%* p.a. on their funding. We’re happy with our development and constant income, which have empowered us on this sustainable development observe.

With over 16 years of expertise, we offer credit score companies to prospects in Estonia, Finland, the Netherlands, and Latvia. Most of our loans in 2023 got here from Finland.

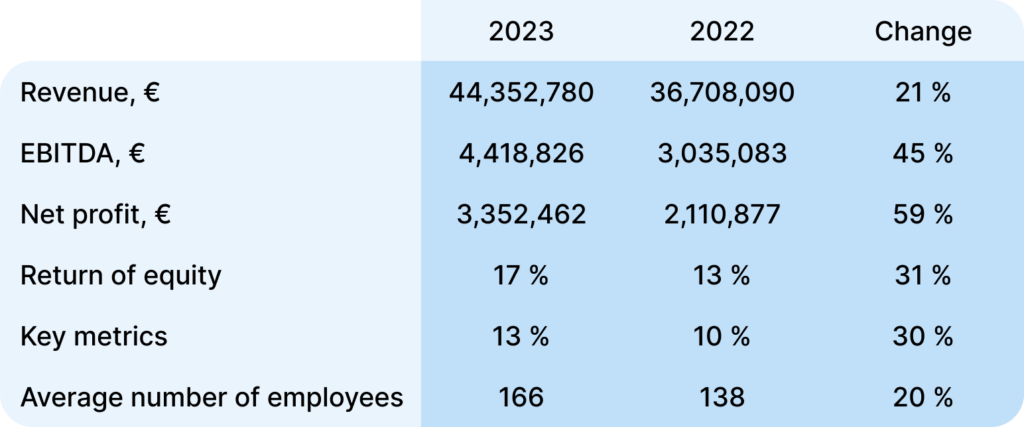

Bondora Group 2023 Monetary Outcomes Desk

EBITDA – earnings earlier than curiosity, tax depreciation and amortization

Return on fairness (ROE) = web revenue or loss for the interval / complete fairness

Return on belongings (ROA) = web revenue or loss for the interval / complete belongings

We’re frequently increasing and bettering our merchandise to succeed in extra folks. Our aim is to have 1 million lively prospects within the coming years. Regardless of challenges within the international fintech market, Bondora Group has continued to hit its development targets.

In 2023, we issued €179 million in loans in Estonia and Finland. We additionally expanded within the Netherlands and entered the Latvian market. Our mortgage origination charges had been €7 million, mortgage administration charges totaled €23.1 million, and income from extra merchandise reached €133 million.

To help this development, we elevated our crew by 28 folks in 2023, bringing our complete worker rely to a median of 166. Regardless of these extra bills, we ended the 12 months with a web revenue of €34 million.

You possibly can learn the complete 2023 Monetary Outcomes Report right here.